Venture capital (VC) is the primary source of financing for early-stage startups bringing their innovation to market. And a disproportionate amount of venture capital goes to startups in the tech sector. However, the last few years have seen a contraction in VC investment, particularly in potential competitors to incumbent digital platforms such as Facebook, Google and Amazon, which some interpret as a sign that the tech incumbents are harming innovation in their product spaces—a harm that needs to be remedied by antitrust intervention. This blog post takes a closer look at what VC can tell us about potential innovation harms in the digital economy.

The venture capital model and the importance of exit strategies

To examine what VC investment can tell us about the state of innovation in the digital economy, we need to understand the VC model. Essentially, it can be boiled down to two numbers: ‘two and twenty’. First, a VC firm sets up a fund and allows limited partners (LPs) to commit capital until it reaches its desired size (say, $100M). From then on, the fund runs for around 10 years: the first 3-5 years are spent actively investing in startups in return for equity; in the remaining years, VCs may still make follow-on investments. Every year of the fund’s life, the VC firm charges a 2% management fee on the committed capital. Towards the end of the fund’s designated lifetime, VCs look for an ‘exit’, i.e. a way to turn their equity stakes in startups liquid. From the returns from this exit, the VC firm retains 20% (‘carry’); the other 80% goes to the LPs.

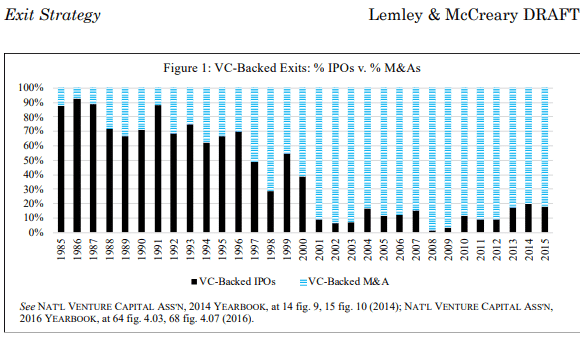

Planning for exit is absolutely crucial: without an exit, VCs and their LPs don’t get paid (and neither do the startup’s founders). Thus, as Lemley and McCreary put it: ‘In Silicon Valley, the most important thing to think about when starting a company is how you’re going to end it.’ The gold standard used to be an exit through initial public offering (IPO), in which the startup’s equity was sold to the public. However, this method of exit is in steep decline: ‘while 1 in 2 exits was by IPO as recently as the 1990s, only about 1 in 10 is today.’ An alternative exit consists in selling the startup to another firm (acquisition). As IPOs declined, such acquisitions have filled the gap: since the 1990s, the number of VC-backed firms being acquired has increased with 140%.

The interface between antitrust and venture capital

The links between venture capital and antitrust are manifold. Obviously, the larger acquisitions of VC-backed firms have been reviewed by competition authorities (e.g. Facebook/WhatsApp), and VCs also serve as commentators on antitrust in the tech sector.

Recently, however, references to VC in antitrust debates have mostly concerned the tech incumbents’ wider impact on innovation. At the basis of this debate is the earlier observation that acquisition is now the preferred exit strategy of VC-backed startups. The acquirer is often an incumbent (e.g. Facebook in social networking); the acquired company is often one of its (at least potential) competitors. Sometimes, the incumbent invests significantly in the acquired company (e.g. Facebook in Instagram, although a recent book shows that Facebook’s intervention wasn’t always considered positive). Other times, the incumbent shuts down the (potential) competitor after acquisition. Facebook, for example, shut down almost half the companies it acquired (including tbh, TheFind, and Branch). If the intent of the acquisition is to eliminate the target’s product so as to pre-empt future competition, it qualifies as a so-called ‘killer acquisition’.

Killer acquisitions are a valid cause for concern, but the issue is hard to remedy. Firstly, merger review is prospective: once the acquisition is approved, the acquirer is free to do what it wants with the acquired target. Secondly, there are often good reasons to shut down an acquired unit (including lesser than expected synergies, changing market conditions, or simply the recognition of a bad bet), which makes it difficult to discern killer acquisitions from acquisition failures. Further, even if the unit was shuttered, perhaps its technology was still used by the acquirer. Or perhaps the acquirer was only interested in the target’s personnel in the first place (a so-called ‘acqui-hire’). However, killer acquisitions are only part of a broader dynamic whereby startups are often acquired by incumbents (sometimes after apparent strong-arming). Moreover, when acquisition is not an option, an incumbent may choose to copy the startup (see the previous CoRe Blog post on this topic). Taken together, these actions are alleged to harm innovation in the tech sphere. But how does one go about testing this hypothesis?

Testing potential harm to innovation: evidence from venture capital

The hypothesis to be tested is essentially the following:

Hypothesis 1. The acquisition (and copying) activity of the tech incumbents results in a ‘kill zone’. Given that startups are either scooped up or copied, VCs are reluctant to invest, in particular in companies that seek to challenge the incumbents. Innovation is thus harmed—in particular, there is a decreased likelihood of disruptive/Schumpeterian innovation that displaces the incumbent.

There is, however, a compelling alternative hypothesis:

Hypothesis 2. IPOs have become scarcer and acquisition is the preferred exit strategy for startups. Given that today’s tech incumbents in the tech sector are eager to acquire startups, VCs are motivated to invest, in particular in companies that seek to challenge the incumbents. Innovation is thus incentivized (and further propelled by the investment of the incumbent after acquisition).

Thus, reduced VC investment would be consistent with hypothesis 1, while stable/increased VC investment would fit better with hypothesis 2. Let us check what the available evidence indicates.

a. Anecdotal evidence

Before jumping into empirical evidence, let us hear from the VCs themselves, to get a clearer sense of the current situation.

A number of them are pessimistic about the impact of the incumbents. ‘The Kill Zone is a real thing’, says one partner at Union Square Ventures. ‘The scale of these companies and their impact on what can be funded, and what can succeed, is massive.’ He also refers to another investor who only invests ‘in things that are not in Facebook’s, Apple’s, Amazon’s or Google’s kill zone.’ Another VC firm partner, at New Enterprise Associates, voices a similar opinion: ‘We don’t touch anything that comes too close to Facebook, Google or Amazon’.

Other VCs don’t really see the problem. The managing director of Menlo Ventures, for example, offered: ‘I don’t think at the end of the day venture capital is worrying about competition from these big platform companies.’ Other VCs have dismissed the idea that today’s tech incumbents can’t be outmaneuvered.

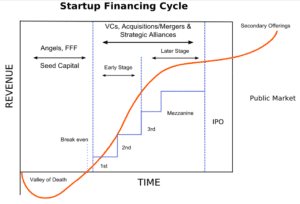

Figure 2. From seed capital to early- and later-stage VC investment (source: Wikimedia)

b. Empirical evidence

Given that the statements of VCs don’t exactly go in the same direction, let’s look beyond the anecdotal evidence. It’s important to note here that there are different kinds of VC funding, depending on the stage the startup is in. At an early stage, a startup may benefit from ‘seed capital’ (usually <$1M) from an angel investor or small VC firm and subsequently a ‘series A’ funding round (of $8M on average). At a later stage, the startup may organize larger ‘series B’ and ‘series C’ funding rounds (of >$15M). However, this categorization is only indicative; different terms and numbers are used depending on the source.

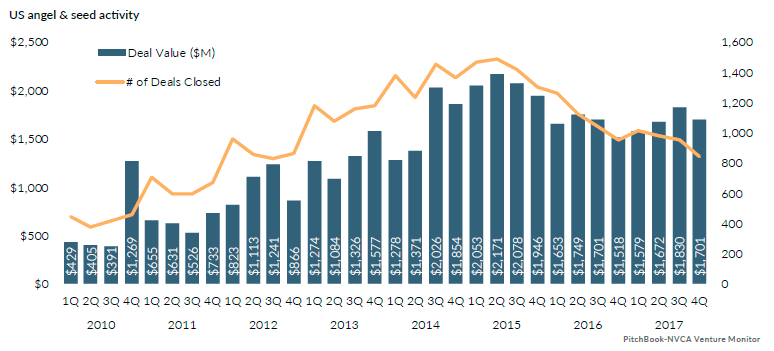

Has this funding changed recently? Looking at data from Pitchbook (on which Caves & Singer 2018 also rely), it’s clear that in the United States the number of deals has dropped between 2015 and 2017, but that deal value has increased over the same period. Looking more closely at the different types of VC funding, one can see that ‘angel and seed activity’ (defined as deals <$2M) have been in particular decline. In case of ‘early-stage VC’ ($2M-$20M) and ‘late-stage VC’ (>$20M), the number of deals is also down, but deal value is flat or up. VCs are thus investing in fewer startups, but are investing greater amounts at later stages. Finally, exits have also declined steeply between 2015 to 2017, but the exits have been bigger, which kept the yearly exit value consistent.

Figure 3. US angel and seed activity (source: Pitchbook-NVCA Venture Monitor)

However, the Pitchbook data above concerns all VC. Even though a lot of that VC goes to the tech sector, not nearly all does. Other sources do cover VC investment in tech specifically, and at a global rather than US scale. In a report commissioned by Facebook, the consulting firm Oliver Wyman has assessed ‘The Impact of Big Tech on Venture Investment’. Relying on Crunchbase data, the report goes into various concerns, including whether ‘FGA’s presence in the technology sector dampens VC activity relative to other sectors’. It notes that ‘[t]he number of technology sector deals has declined by 21 percent a year between 2015 and 2017, while other sectors have grown 5 percent annually in the same period.’ The report argues that this decline is explained by the maturity of the sector. Moreover, according to the report, deal value is up, which is explained by an increase in the number of ‘mega-rounds’ (led by Softbank’s Vision Fund, for example).

The Oliver Wyman report is thus not exactly conclusive either, although it confirms that fewer early-stage startups are getting funded. However, Ian Hathaway finds the report flawed, in particular because of its lack of granularity: it looks at the broad tech industry while pretending to measure the impact of the few tech incumbents specifically. To correct the analysis, Hathaway looks at the detailed industries that FGA operate in, to assess their impact on ‘first financings’, which is when startups enter the venture-backed pipeline. Based on Pitchbook data, he concludes that ‘the number of companies entering the venture-backed pipeline in industries that are in direct competition with core FGA activities have been on a steady and persistent decline [25%-40% over 2015-2017] that exceeds comparable groups.’

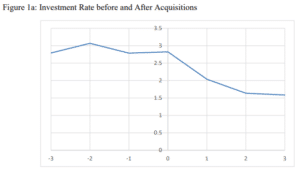

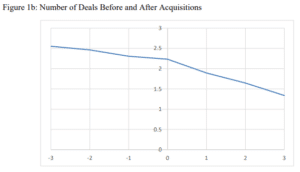

Finally, Kamepalli, Rajan and Zingales built a model showing that ‘acquisitions of new entrants at generous multiples by incumbent digital platforms can lead to a decrease in new entry and a decrease in the amounts invested in similar businesses at similar stages of development.’ They also test this finding empirically (relying on Pitchbook data), looking at deals and dollar amounts invested after acquisitions by Facebook and Google. They find that ‘VC investments in start-ups in the same space as the company acquired by Google and Facebook drop by 46% and the number of deals by 42% in the three years following an acquisition.’

Figure 4. Investment rate in three years before/after acquisition

(source: Kamepalli, Rajan & Zingales 2019)

Conclusion

What to make of the above evidence? It does appear that less VC investment started flowing to fewer entrants in the tech sector, in particular in the spaces that FGA operate in. This observation supports one part of hypothesis 1, namely that ‘VCs are reluctant to invest, in particular in companies that seek to challenge the incumbents’, at least when it comes to early-stage startups.

It is more difficult to conclude anything as to the reason of this contraction in investment. Is it the conduct of the tech incumbents? And if so, which kind of conduct: their acquisition activity, their tendency to copy competitors, or the way in which they leverage market power to adjacent markets? Kamepalli et al. suggest that acquisitions are a plausible answer (after discounting alternative explanations).

Given this support for (part of) hypothesis 1, the alternative hypothesis 2 becomes less plausible. Remember that this hypothesis held that acquisitions by tech incumbents provide startups with a good exit strategy, which increases incentives to invest (as argued by Daniel Sokol and Andrew Finch, for example).

Finally, what is the result of this contraction in VC investment? One could plausibly argue that reduced VC investment in startups decreases their odds of one day growing into serious competitors to the tech incumbents. In other words, there is a decreased likelihood of innovation (in particular of the disruptive/Schumpeterian kind) in the tech sector. However, one could also argue that VC investment has simply been diverted to other sectors, so that overall innovation hasn’t decreased. In addition, one could argue that the current concentration in the tech sector is actually the most desirable state of affairs (due to network effects, among others).

Of course, this blog post only provides a preliminary exploration of the lessons that antitrust enforcers can draw from trends in venture capital. Moreover, the time period under examination (2015-2017) may be an outlier, which is why a subsequent blog post will look at what happened since then, as well as potential remedies (such as retrospective merger analyses). In the meantime, any comments and further references are most welcome.