For valuation of public land to be credible, it should preferably be carried out by external experts.

Introduction

In December 2011, the Commission asked the Spanish authorities for information on alleged state aid in the transfer of public land from Madrid City Council to Real Madrid football club. In December 2013, the Commission decided to open the formal investigation procedure which was concluded in July 2016 with decision 2016/2393. In that decision the Commission found that the measure in question was a swap of public for private land, whose values, however, did not correspond to then prevailing market prices. Therefore, it contained state aid which was incompatible with the internal market and had to be recovered.

Real Madrid appealed and in 2019, the General Court, in case T-791/16, Real Madrid v Commission, annulled decision 2016/2393, primarily on the ground that the Commission had not taken into account the value of all plots involved in the transfer. A plot – named B-32 – that was supposed to be transferred to Real Madrid in the end was not transferred. Instead, Madrid City Council transferred three other plots. Consequently, the Commission re-opened the case and re-examined the value of all plots. It concluded in August 2025, in decision 2025/2488, that the transfer was free of state aid.[1]

The only issue that needed to be examined in detail in the 2025 decision was whether Real Madrid obtained an advantage that was unavailable under normal market conditions, i.e. without the intervention of the state. All the other criteria of Article 107(1) TFEU were satisfied. In order to determine the presence or absence of advantage, the Commission applied the market economy operator principle [MEOP].

[1] The full text of the Commission decision was published in the Official Journal on 22 December 2025. It can be accessed at:

https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=OJ:L_202502488

Applicability of the market economy operator principle

First, the Commission examined whether the MEOP was applicable to this case.

It explained that “(109) in its 2019 judgment, the General Court found in paragraph 51 that ‘the applicability of the private investor criterion requires that it be established, unequivocally and on the basis of objective and verifiable evidence, that there was an evaluation comparable

to one to which a private operator would have access prior to or at the point of adoption of the measure at issue’.” “(110) Furthermore, the General Court confirmed … that ‘the Kingdom of Spain could have relied on any legal analysis which Madrid City Council would have drawn up in the circumstances given in paragraph 51’. The General Court also clarified that such a legal analysis ‘did not mean only external advice’.”

Then the Commission explained that its investigation showed “(111) that the Madrid City Council collected and considered the following evidence prior to the signing of the 2011 settlement agreement.” “(112) The Madrid City Council’s three reports were prepared by experts in the urban, legal and financial departments of Madrid City Council and signed before the signature of this agreement … Based on their assessment of this evidence, the experts advised the local authority to sign the 2011 settlement agreement, before such signing took place.”

“(113) Furthermore, the Spanish authorities also provided to the Commission detailed observations prepared by Madrid City Council. The Commission notes that these observations include a detailed legal analysis by Madrid City Council based not only on their interpretation of the relevant Spanish and regional urban and civil law provisions, but also on Madrid City Council’s practice, as well as case-law and doctrine applicable to the present case”.

“(117) That legal analysis allowed Madrid City Council to consider, in the framework of its decision-making process, the different options legally available and their economic consequences. In the 2011 settlement agreement, the parties agreed to settle their dispute through the transfer to Real Madrid of the three other plots. The Commission notes that, as stated by Madrid City Council and Real Madrid, this settlement avoided an outcome, i.e. the termination of the agreement, which would have been much more onerous for Madrid City Council”.

“(118) In view of the above, the Commission does not contest the applicability of the market economy operator principle to Madrid City Council when signing the 2011 settlement agreement.”

“(119) The Commission has no indications that the legal analysis made by the Spanish authorities as described above, or the sources the Spanish authorities relied on when carrying out such analysis, were incorrect.”

“(120) The observations submitted by interested parties do not provide facts or substantiate claims demonstrating that the analysis carried out by the Spanish authorities was incorrect. Therefore they do not change this conclusion”.

Application of the market economy operator principle

The Commission, first, recalled that “(123) the General Court [stated] in the 2019 judgment that, ‘in order to determine whether the sale of land by public authorities to a private individual constitutes State aid, the Commission must apply the test of a private investor in a market economy, to determine whether the price paid by the presumed recipient of the aid corresponds to the selling price which a private investor, operating in normal competitive

conditions, would be likely to have fixed. As a rule, the application of that test requires the Commission to make complex economic assessment.’”

“(124) Furthermore, the General Court found that, ‘it is thus necessary to assess whether, having regard to the initial intention of the parties to the 1998 implementation agreement, and also to the regulations applicable to plot B-32, both at the date at which the implementation agreement was signed and at the date of the signing of the 2011 settlement agreement, it is reasonable to think that a market economy operator would have accepted to pay all the compensation for the non-transferral of the plot concerned, which was estimated to be equal to the value of that plot, namely EUR 22 690 000’.”

“(126) On 27 July 2011 (i.e. before the signature of the settlement agreement), the services of Madrid City Council calculated the ownership value of plot B-32 at that date at EUR 22 693 054,44. According to the Spanish Ministry of Finance, the ownership value of plot B-32 in 2011 was estimated at EUR 25 776 296 … The valuation made by the consultant Aguirre Newman on behalf of Real Madrid indicated that the market value of plot B-32 in 2011 was of EUR 22 690 000 … The consultant TINSA also set the ownership value of plot B-32 for Real Madrid at EUR 23 000 000”.

“(127) According to Madrid City Council’s services, the three other plots had a value in 2011 of EUR 19 972 348,96 … In a report commissioned by the Commission, TINSA … estimated the value of the three other plots at EUR 21 100 000. On behalf of Real Madrid, the consultant Aguirre Newman estimated the value of the three other plots in 2011 at EUR 12 385 000”.

“(128) The Commission considers that the conditions for the application of the market economy operator principle are satisfied in the present case, based on the following considerations.”

“(129) According to Madrid City Council’s legal analysis, carried out on the basis of objective and verifiable evidence collected prior to or at the point of signing the 2011 settlement agreement …, Real Madrid was entitled to receive a compensation for the breach of the 1998 implementation agreement. Such a compensation should be of a value equal to the value of the ownership of plot B-32 in 2011”.

“(130) Furthermore, Madrid City Council and Real Madrid claim that the Madrid City Council’s services in charge of the valuation of land plots were professional valuation experts legally bound by the principles of objectivity and impartiality. They estimated the value of plots owned by the public administrations, as required by the law, and their valuations are presumed accurate before national courts … Based on this, Real Madrid considered that the valuation of plot B-32 made in 1998 and in 2011 by the technical services of Madrid City Council constituted independent valuations”.

“(131) In addition, the consultant Aguirre Newman, on behalf of Real Madrid, estimated the value of plot B-32 in 2011 at EUR 22 690 000. The Commission notes that, although the methodologies used by the services of Madrid City Council and Aguirre Newman to estimate the value of plot B-32 were different, the result of their valuations were almost identical.”

“(132) The Commission takes also into account that, according to Madrid City Council and Real Madrid, the public real estate cadastre, a service within the Spanish Ministry of Finance and independent from Madrid City Council, estimated the value of plot B-32 in 2011 at EUR 25 776 296.”

“(134) Regarding the three other plots, Real Madrid accepted the valuation of the three other plots carried out by the services of Madrid City Council and agreed to it in the 2011 settlement agreement”.

“(136) The values of plot B-32 and the three other plots, as estimated by the services of the Madrid City Council, fall within the range of values estimated in the different valuations submitted to the Commission by Real Madrid and the valuation of the three other plots prepared by TINSA on behalf of the Commission.”

“(137) The observations submitted by other interested parties do not provide facts or substantiate claims demonstrating that the valuations carried out by the services of Madrid City Council were incorrect. Therefore, they do not change this consideration.”

“(138) In light of the above considerations, the Commission concludes that it is reasonable to think that a market economy operator would have accepted to pay Real Madrid a compensation for the non-transferral of plot B-32, which was estimated to be equal to the ownership value of that plot in 2011.”

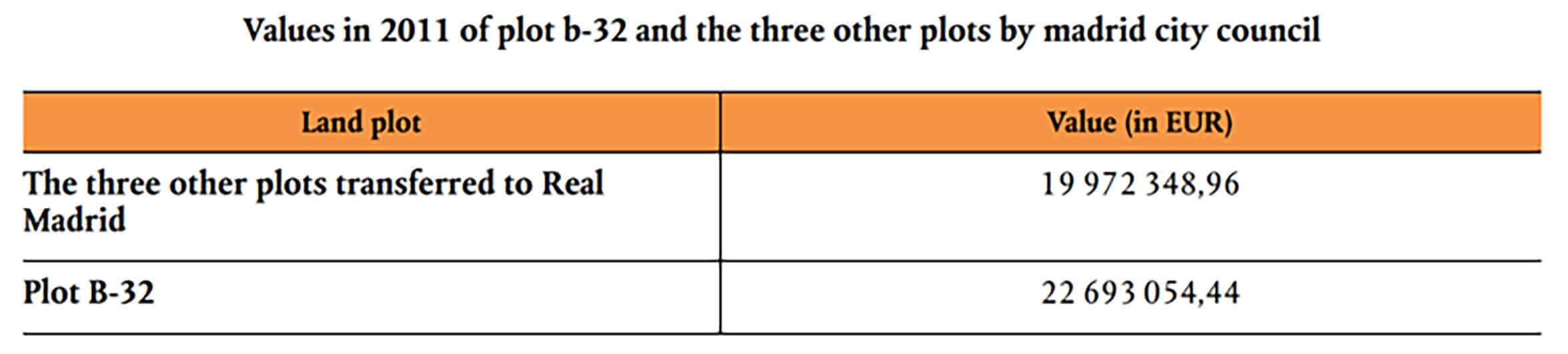

“(139) The Commission also considers that the values to be compared in order to calculate the compensation due to Real Madrid under the 2011 settlement agreement should be those estimated by the services of Madrid City Council for the purposes of such agreement, as shown in table 3 below”.

Table 3

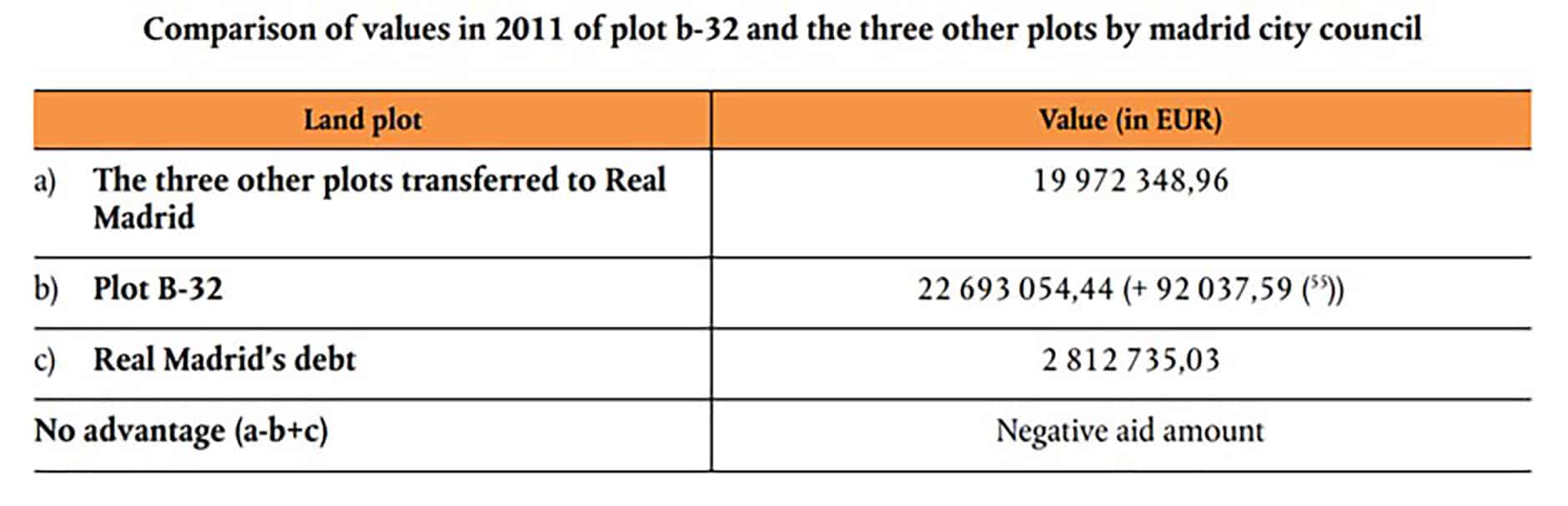

“(140) In the 2011 settlement agreement, Madrid City Council and Real Madrid also agreed that Real Madrid owed Madrid City Council an amount of EUR 2 812 735,03, as compensation for its failure to comply with certain contractual obligations under the 1991 agreement”.

“(141) To assess the potential advantage of Real Madrid, the Commission considers not only the ownership 2011 values as estimated by the services of Madrid City Council (see table 3 above), but also Real Madrid’s debt with Madrid City Council as mentioned above in recital (140), as follows:”

Table 4

Conclusions

On the basis of the above analysis, the Commission concluded that no advantage had been conferred to Real Madrid through the transfer of land. The City had to pay EUR 22.693 million. Real Madrid owed the City EUR 2.813 million. This meant that the amount that had to be paid by the City to Real Madrid was EUR = 19.880 million [= 22.693 – 2.813]. However, the value of the three other plots that had already been transferred were valued at EUR 19.972 million. That is, the City appeared to overcompensate Real Madrid by EUR 92,000. However, footnote 55 in Table 4 explained that tax already paid by the City amounting to EUR 92,038 had to be added to the value of plot B-32. That amount balanced out the apparent overcompensation.