Introduction

The Finnish state owned 100% of four different companies which operated risk capital and private equity. One of those four companies was “Tesi”. Finland proposed the consolidation of the other three companies – with an estimated value of EUR 500 million – into Tesi. In addition, Finland intended to inject extra capital of EUR 300 million in Tesi. For purposes of legal certainty, it notified the measure to the Commission [see SA.113383: Consolidation of Finnish Tesi Group].[1] Three of those companies operated on market terms. The fourth – “Business Finland Venture Capital” [BFVC] – invested on preferential terms to support public policy objectives.

BFVC made some investments that constituted State aid authorised by the Commission [see Commission decision SA.104831]. Its assets that supported State aid measures would be transferred to a new wholly owned subsidiary of Tesi under the name of “Teollisuustuki”. The remaining assets of BFVC that did not support investments containing State aid would be absorbed by Tesi.

As explained in the Commission decision, the total assets of Tesi, as a result of the consolidation, would be as follows:

“(8) (i) total investments of EUR 981.7 million, long-term Loans Receivables of EUR 5.6 million, other shares and interests of EUR 16.3 million, other receivables of EUR 47.7 million;

(ii) long-term receivables of EUR 1.8 million, short-term receivables of EUR 18.9 million, financial securities of EUR 614.6 million and cash and bank receivables of EUR 169.1 million.

All of Tesi’s assets, excluding its participation in Teollisuustuki, would make up 92% (or EUR 1.856 billion) of the new entity, the remaining 8% (or EUR 156 million) would stay at the subsidiary Teollisuustuki.”

“(9) Finland intends to fully separate the activities of Tesi and Teollisuustuki and will put in place safeguards to avoid any cross subsidization between both entities, carrying out, respectively, market conform and aided activities”.

In the decision, the Commission assessed the applicability and application of the market economy investor principle [MEIP], to ensure the absence of State aid, and verified the robustness of the safeguards that were intended to prevent cross-subsidisation between Tesi and Teollisuustuki.

Conformity with the MEIP

Finland’s view was that the consolidation and the capital injection did not constitute State aid. “(17) The Finnish authorities state that the capital injection into Tesi relies on the benchmarking method as define d by paragraphs 98 to 100 of the Commission Notice on the notion of State aid as referred to in Article 107(1) of the Treaty on the Functioning of the European Union (‘NoA’). Such a capital injection will therefore be made in line with market conditions, namely ensuring that the Finnish State acts as a market economy operator. The benchmarking is based on the assessment of Tesi’s business plan concerning the use of the capital injection. The Finnish government’s expected return on investment, namely the income received by Tesi from investments less its operating expenses, is [7%-10%] – [14%-17%], a range that the Finnish authorities consider to be in line with market conditions.” At this point footnote no. 10 states: “The Finnish Government’s expects that Tesi’s future profit made by the new capital would be [8-11%] – [14-17%]. Since the Government’s return on the capital injection will basically be the income received by Tesi less the operating expenses of Tesi, the Government’s expected return requirement to the investment is [7%-10%] – [14%-17%].”

Finland’s position was based on an assessment carried out by independent experts. Accordingly, Tasi’s expected return from “(20) scale-up investments are [18%-21%] – [23%- 26%] (per individual investment) and [13%-16%] (per individual investment) from industrial-scale projects”.

And, “(22) […] Tesi has also considered that some investment targets can fail to meet their return expectation, resulting in an estimated portfolio yield of [8-11%] – [14-17%] in total, leading to an expected return on investment of [7%-10%] – [14%-17%] after Tesi’s operating costs; […] the extended Capital Asset Pricing Model (CAPM) has been considered to estimate the required rate of return for Tesi’s direct investment program. Using a long-term risk-free rate assumption of 3.50%, a beta of 1.1 – 1.7, a long term equity risk premium for Western European stocks of 4.50%, and an additional risk premium of [1-3%] – [4-7%] when considering individual targets, leads to an equity return requirement of [9-12%] – [15-18%]”.

Furthermore, “(27) The Finnish authorities confirmed that Tesi will operate strictly in conformity with the market economy operator principle (‘MEOP’) as provided in the Tesi Act.” “(28) Tesi will invest either on strict pari passu terms with private investors, in line with paragraphs 86 to 88 NoA; or it will adhere to an investment scenario where market conformity can be directly inferred using benchmarking methods outlined by paragraphs 98 to 100 NoA.”

Next, Finland outlined the terms of co-investment with private investors.

Terms of co-investment with private investors

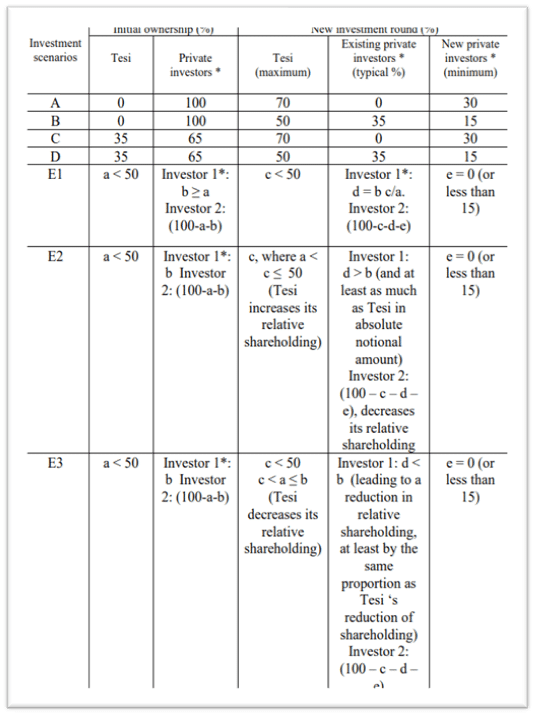

The table below, reproduced from the decision, illustrates all conceivable investment cases, where, according to the Finnish authorities, strict pari passu conditions would not necessarily hold, because of an asymmetry in the ex-ante exposures between Tesi and the private investors.

“(34) The Finnish authorities commit that all Tesi’s investments will fall under the scope of these scenarios, in which Tesi will remain a minority shareholder, i.e. after the investment round Tesi’s total share in the target will remain below 50%. The scenarios are exhaustive in a sense that Tesi’s share in a new investment round can never be higher than that in the table, namely at maximum 70% if new private investors invest at least 30% (scenarios A and C) and at maximum 50% in scenarios B, D and E. Other examples are possible in two respects: (a) Tesi’s share in a new investment round can be lower than indicated in the table (and private investors share can be higher than in the table) and (b) Tesi’s initial share in scenarios C, D and E can vary, in principle between 1% and 49%.”

“(35) Tesi’s investments are made on a symmetrical basis with private coinvestors, who typically invest at least 50%, and in any case at least 30% of the investment. In the latter case, the private investors will be new, independent from the existing shareholders.”

“(36) However, as described with respect to scenario E […], the Finnish authorities state that it is a common practice in risk capital investments that not all existing investors participate pro rata in all subsequent investment rounds.”

“(37) Therefore, the Finnish authorities consider that the share of private investors is economically meaningful and the compliance with the MEOP will also be validated, if new independent private investors contribute at least 30% in the investment round (Tesi can invest up to 70%) as in scenarios A and C; or new and existing investors contribute at least 50% in the investment round (Tesi can invest up to 50%) with the restrictions in scenarios B, D and E”.

Separation of activities between Tesi and Teollisuustuki

“(40) While Tesi is foreseen to continue to operate in line with market conditions, Teollisuustuki will focus on investments involving only State aid and all financing granted by Teollisuustuki will comply with the applicable State aid rules (e.g., GBER or De minimis Regulation). Moreover, the Industrial Aid Act contains a provision according to which the financing and investments by Teollisuustuki can be implemented only after the Commission has approved the relevant decision, where so required by the European Union’s State aid provisions. To avoid cross-subsidisation between Tesi and its subsidiary, the Finnish authorities committed to include […] safeguards, […], either in the Acts establishing the new set-up, the forthcoming government Decree or Tesi’s group statutes.

“(41) The Finnish authorities confirmed that Tesi and Teollisuustuki are separate legal entities. They will operate under their own distinct brands. Each company must keep its own accounts. Tesi and Teollisuustuki have their own separate assets and they prepare their own separate annual financial statements with the help of an external auditor. Tesi does not assume any liability for debts, commitments and liabilities of Teollisuustuki.”

Moreover, Tesi will not be involved in decisions granting State aid, Tesi and Teollisuustuki will not invest in the same company, nor will they finance each other.

Given that Teollisuustuki is a wholly-owned subsidiary of Tesi, the Commission decision provides interesting details of their supervisory and management separation. Teollisuustuki’s board is independent and its members cannot participate in Tesi’s board or management. Tesi cannot unilaterally appoint members of the board of Teollisuustuki. Such appointments need the authorisation of the Ministry of Economic Affairs.

Commission assessment

The decisive element in the Commission’s analysis was the presence or absence of advantage. The Commission examined both the transfer of assets amounting to EUR 500 million to Tesi, with the exclusion of assets of about EUR 160 million that would remain in Teollisuustuki.

First, it verified that neither Tesi nor Teollisuustuki could have access to each other’s funds. This was ensured by the account separation, the charging of market rates to any services that they could provide to each other and by their distinct management structures.

Next, it examined the capital injection into Tesi. “(64) In order to establish whether the capital injection of EUR 300 million, […], is done in accordance with the MEO test, the Commission notes that the Finnish authorities have used the CAPM methodology to estimate a return target at [7%-10%] – [14%-17%]. That valuation will be assessed against terms under which comparable transactions carried out by comparable private operators have taken place in comparable situations (recital (22)(d)). The Commission will use a benchmarking approach”.

“(66) The Finnish authorities provided a benchmarking methodology to justify the equity returns on investment for the planned capital injection. The Commission has reviewed the benchmarking methodology of the independent expert and agrees with its conclusion. The CAPM, […], considered to estimate the required rate of return for Tesi’s direct investment program, shows that usage of a long-term risk-free rate assumption of 3.50%, a beta of 1.1 – 1.7, a long term equity risk premium for Western European stocks of 4.50%, and an additional risk premium of [1-3%] – [4-7%] when considering individual targets, leads to an equity return requirement of [9-12%] – [15-18%], which is comparable to the expected return on Tesi investment of [7%-10%] – [14%-17%] […] Moreover, the independent expert has provided historical returns for private equity returns of public pension funds over the period 2014-2023 as an additional justification. The Commission finds these returns consistent with the projected returns on Tesi’s future investments, therefore validating Tesi’s assumptions.”

“(69) The Commission therefore concludes that, if the market conformity of Tesi’s investment activities can be established, the capital injection complies with the MEO test, as provided by paragraphs 98 to 100 NoA on the benchmarking methods.”

Market conformity of Tesi’s investment activities

Therefore, the next step for the Commission was to examine whether the investments carried out by Tesi would be similar to those of private investors.

“(71) When a transaction is carried out under the same terms and conditions (and therefore with the same level of risk and rewards) by public bodies and private operators who are in a comparable situation (a ‘pari passu’ transaction), it can normally be inferred that such a transaction is in line with market conditions. The interventions of Tesi, […], will be decided and carried out on pari passu terms, namely, at the same time as private investors’, the terms and conditions of the transaction will be the same as for all private operators involved, the intervention of the private operators will have real economic significance and will not be merely symbolic or marginal, and the starting position of Tesi and the private operators involved will be comparable with regard to the transaction, taking into account their prior economic exposure vis-à-vis the undertakings concerned, the possible synergies which can be achieved and the extent to which the different investors bear similar transaction costs. The Commission therefore concludes that Tesi will invest on pari passu terms with private investors in line with paragraphs 86 to 88 NoA.”

“(72) In some situations, Tesi will make investments without relying on pari passu terms, […], but in such cases compliance with market conditions can still be assessed through benchmarking.”

“(73) Benchmarking is not an appropriate method to establish market prices if the available benchmarks have not been defined with regard to market considerations or the existing prices are significantly distorted by public interventions. Conversely, benchmarking could be found as an appropriate method if the available benchmarks have been defined with regard to market considerations. In each of the scenarios, an investment made by an independent private investor […] will function as a market benchmark.”

Conclusion

On the basis of the above analysis, the Commission concluded that “(84) Tesi will: (i) be funded on market terms; and (ii) develop and pursue its own activities without any reference to the activities of the subsidiary Teollisuustuki and on market terms. As a result, Tesi will not receive any economic advantage in comparison to other commercial market participants. Therefore, the conditions for the existence of State aid within the meaning of Article 107(1) TFEU are not fulfilled.”

[1] The full text of the Commission decision can be accessed at:

https://ec.europa.eu/competition/state_aid/cases1/202526/SA_113383_115.pdf