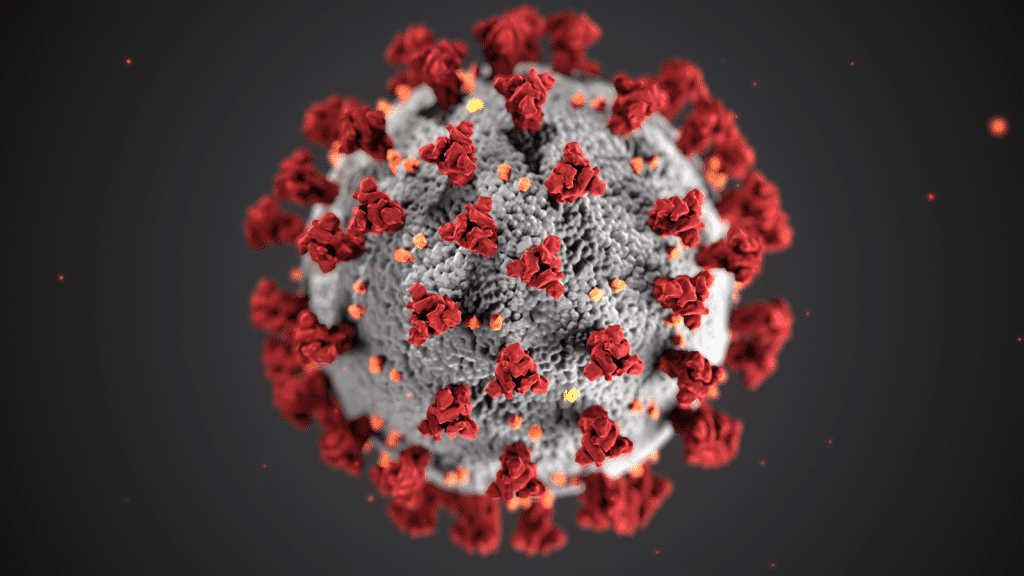

We are happy to share with you an update on the Covid-19 measures that have been approved in Belgium. Our guest auhor Wout De Cock is a PhD candidate at the Vrije Universiteit Brussel and part-time teaching assistant at the Katholieke Universiteit Leuven.* Introduction In issue 1/2020 of the European State Aid Law Quarterly, we concluded that the European Commission […]

State Aid Law

Blog

State Aid Uncovered Blog

In Lexxion’s State Aid Uncovered blog, Prof. Phedon Nicolaides publishes weekly critical analyses of recent State aid judgments and decisions. Each post presents the key points of a court judgment or EU Commission decision, places it in the context of similar case law or practice, assesses the underlying reasoning and highlights any inconsistencies or contradictions.

Guest contributions from other State aid experts will also be published on the blog at irregular intervals to complement the content of the blog posts.

- airport ×

14. May 2020 |

Guest State Aid Blog

by Wout De Cock

14. April 2020 |

State Aid Uncovered

by Phedon Nicolaides

Interested parties have a right to know how the compatibility of aid with the internal market is assessed. Temporary Framework developments As of 13 April 2020, the European Commission had authorised 51 measures adopted by 23 Member States. According to the statement of the Eurozone finance ministers of 9 April 2020, Member States had provided liquidity in the form of […]

7. April 2020 |

State Aid Uncovered

by Phedon Nicolaides

The principle of res judicata cannot be used to avoid recovery of incompatible State aid. An update on State aid measures to counter the impact of COVID-19 As of 3 April 2020, the Commission has approved 29 measures submitted by 16 Member States. Article 107(3)(b) is the legal basis for 26 of those measures, while Article 107(2)(b) is the […]

23. May 2017 |

State Aid Uncovered

by Phedon Nicolaides

Fees charged by operators to users of infrastructure must cover all relevant costs. The relevant costs are those which are causally linked to the agreements between users and operators. Introduction The rules in the Treaty on the Functioning of the European Union are neutral in their treatment of private or state-owned companies [Article 345 TFEU]. This means that companies cannot […]

1. December 2015 |

State Aid Uncovered

by Phedon Nicolaides

State aid is granted on the date the relevant public authority makes an irrevocable commitment to grant it or creates a legal entitlement for the beneficiary. Loans that impose public policy obligations on borrowers are not in conformity with the behaviour of a private investor. Introduction This is a rather long article because it examines a rich case that […]

6. May 2015 |

State Aid Uncovered

by Phedon Nicolaides

In managing infrastructure, a public authority acts as a private operator when it seeks a reasonable return on its investment and also takes into account the alternative of not operating the infrastructure. The manager of an infrastructural project may charge different fees to different users to optimise usage and increase revenue. Introduction This article reviews Commission decision 2015/506 concerning […]

14. September 2013 |

State Aid Uncovered

by Phedon Nicolaides

Background Portugal notified to the Commission the privatisation of the “Aeroportos de Portugal” [ANA] for reasons of legal certainty [SA.36197].[1] ANA is the operator of most Portuguese airports. It manages eight airports across Portugal (Lisbon, Porto, Faro, Beja, and 4 airports in the Azores) that account for the vast majority of the commercial air traffic in the country. It is worth […]

9. May 2013 |

State Aid Uncovered

by Phedon Nicolaides

This posting examines an Irish and a German measure concerning reduction in passenger taxes. As to be expected, an important issue for both measures was whether the reduction was selective or not. The analysis of the Commission does not really break new ground. What is more instructive with these two cases is the range and ingenuity of the arguments advanced […]

30. March 2013 |

State Aid Uncovered

by Phedon Nicolaides

During the past 18 months or so, the European Commission has launched more than 20 investigations in the funding of regional airports and the arrangements that these airports have concluded with budget airlines such as Ryanair. This posting analyses a very recent Commission decision which found that no State aid was granted to either the airport operator or Ryanair. This […]

- airport ×

14. May 2020 |

Guest State Aid Blog

by Wout De Cock

We are happy to share with you an update on the Covid-19 measures that have been approved in Belgium. Our guest auhor Wout De Cock is a PhD candidate at the Vrije Universiteit Brussel and part-time teaching assistant at the Katholieke Universiteit Leuven.* Introduction In issue 1/2020 of the European State Aid Law Quarterly, we concluded that the European Commission […]

14. April 2020 |

State Aid Uncovered

by Phedon Nicolaides

Interested parties have a right to know how the compatibility of aid with the internal market is assessed. Temporary Framework developments As of 13 April 2020, the European Commission had authorised 51 measures adopted by 23 Member States. According to the statement of the Eurozone finance ministers of 9 April 2020, Member States had provided liquidity in the form of […]

7. April 2020 |

State Aid Uncovered

by Phedon Nicolaides

The principle of res judicata cannot be used to avoid recovery of incompatible State aid. An update on State aid measures to counter the impact of COVID-19 As of 3 April 2020, the Commission has approved 29 measures submitted by 16 Member States. Article 107(3)(b) is the legal basis for 26 of those measures, while Article 107(2)(b) is the […]

23. May 2017 |

State Aid Uncovered

by Phedon Nicolaides

Fees charged by operators to users of infrastructure must cover all relevant costs. The relevant costs are those which are causally linked to the agreements between users and operators. Introduction The rules in the Treaty on the Functioning of the European Union are neutral in their treatment of private or state-owned companies [Article 345 TFEU]. This means that companies cannot […]

1. December 2015 |

State Aid Uncovered

by Phedon Nicolaides

State aid is granted on the date the relevant public authority makes an irrevocable commitment to grant it or creates a legal entitlement for the beneficiary. Loans that impose public policy obligations on borrowers are not in conformity with the behaviour of a private investor. Introduction This is a rather long article because it examines a rich case that […]

6. May 2015 |

State Aid Uncovered

by Phedon Nicolaides

In managing infrastructure, a public authority acts as a private operator when it seeks a reasonable return on its investment and also takes into account the alternative of not operating the infrastructure. The manager of an infrastructural project may charge different fees to different users to optimise usage and increase revenue. Introduction This article reviews Commission decision 2015/506 concerning […]

14. September 2013 |

State Aid Uncovered

by Phedon Nicolaides

Background Portugal notified to the Commission the privatisation of the “Aeroportos de Portugal” [ANA] for reasons of legal certainty [SA.36197].[1] ANA is the operator of most Portuguese airports. It manages eight airports across Portugal (Lisbon, Porto, Faro, Beja, and 4 airports in the Azores) that account for the vast majority of the commercial air traffic in the country. It is worth […]

9. May 2013 |

State Aid Uncovered

by Phedon Nicolaides

This posting examines an Irish and a German measure concerning reduction in passenger taxes. As to be expected, an important issue for both measures was whether the reduction was selective or not. The analysis of the Commission does not really break new ground. What is more instructive with these two cases is the range and ingenuity of the arguments advanced […]

30. March 2013 |

State Aid Uncovered

by Phedon Nicolaides

During the past 18 months or so, the European Commission has launched more than 20 investigations in the funding of regional airports and the arrangements that these airports have concluded with budget airlines such as Ryanair. This posting analyses a very recent Commission decision which found that no State aid was granted to either the airport operator or Ryanair. This […]

- airport ×

14. May 2020 |

Guest State Aid Blog

by Wout De Cock

We are happy to share with you an update on the Covid-19 measures that have been approved in Belgium. Our guest auhor Wout De Cock is a PhD candidate at the Vrije Universiteit Brussel and part-time teaching assistant at the Katholieke Universiteit Leuven.* Introduction In issue 1/2020 of the European State Aid Law Quarterly, we concluded that the European Commission […]

14. April 2020 |

State Aid Uncovered

by Phedon Nicolaides

Interested parties have a right to know how the compatibility of aid with the internal market is assessed. Temporary Framework developments As of 13 April 2020, the European Commission had authorised 51 measures adopted by 23 Member States. According to the statement of the Eurozone finance ministers of 9 April 2020, Member States had provided liquidity in the form of […]

7. April 2020 |

State Aid Uncovered

by Phedon Nicolaides

The principle of res judicata cannot be used to avoid recovery of incompatible State aid. An update on State aid measures to counter the impact of COVID-19 As of 3 April 2020, the Commission has approved 29 measures submitted by 16 Member States. Article 107(3)(b) is the legal basis for 26 of those measures, while Article 107(2)(b) is the […]

23. May 2017 |

State Aid Uncovered

by Phedon Nicolaides

Fees charged by operators to users of infrastructure must cover all relevant costs. The relevant costs are those which are causally linked to the agreements between users and operators. Introduction The rules in the Treaty on the Functioning of the European Union are neutral in their treatment of private or state-owned companies [Article 345 TFEU]. This means that companies cannot […]

1. December 2015 |

State Aid Uncovered

by Phedon Nicolaides

State aid is granted on the date the relevant public authority makes an irrevocable commitment to grant it or creates a legal entitlement for the beneficiary. Loans that impose public policy obligations on borrowers are not in conformity with the behaviour of a private investor. Introduction This is a rather long article because it examines a rich case that […]

6. May 2015 |

State Aid Uncovered

by Phedon Nicolaides

In managing infrastructure, a public authority acts as a private operator when it seeks a reasonable return on its investment and also takes into account the alternative of not operating the infrastructure. The manager of an infrastructural project may charge different fees to different users to optimise usage and increase revenue. Introduction This article reviews Commission decision 2015/506 concerning […]

14. September 2013 |

State Aid Uncovered

by Phedon Nicolaides

Background Portugal notified to the Commission the privatisation of the “Aeroportos de Portugal” [ANA] for reasons of legal certainty [SA.36197].[1] ANA is the operator of most Portuguese airports. It manages eight airports across Portugal (Lisbon, Porto, Faro, Beja, and 4 airports in the Azores) that account for the vast majority of the commercial air traffic in the country. It is worth […]

9. May 2013 |

State Aid Uncovered

by Phedon Nicolaides

This posting examines an Irish and a German measure concerning reduction in passenger taxes. As to be expected, an important issue for both measures was whether the reduction was selective or not. The analysis of the Commission does not really break new ground. What is more instructive with these two cases is the range and ingenuity of the arguments advanced […]

30. March 2013 |

State Aid Uncovered

by Phedon Nicolaides

During the past 18 months or so, the European Commission has launched more than 20 investigations in the funding of regional airports and the arrangements that these airports have concluded with budget airlines such as Ryanair. This posting analyses a very recent Commission decision which found that no State aid was granted to either the airport operator or Ryanair. This […]