Introduction Public land is a public asset that must be priced correctly when rented out to third parties. The problem is that in most cases rented out plots of public land are either too large or are in unusual places. In either case, comparable commercial transactions are difficult to find, especially if transactions in such plots are infrequent. In these […]

State Aid Law

Blog

State Aid Uncovered Blog

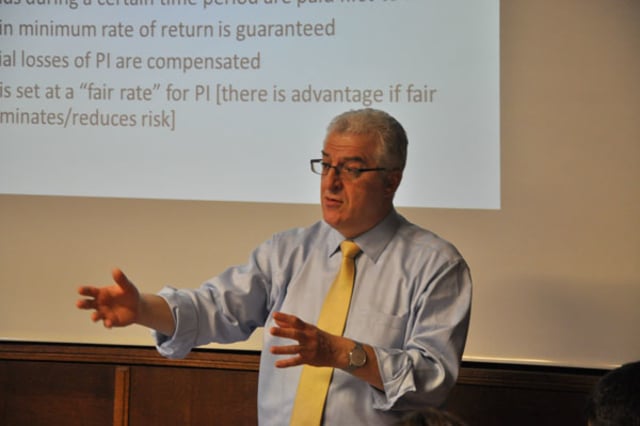

In Lexxion’s State Aid Uncovered blog, Prof. Phedon Nicolaides publishes weekly critical analyses of recent State aid judgments and decisions. Each post presents the key points of a court judgment or EU Commission decision, places it in the context of similar case law or practice, assesses the underlying reasoning and highlights any inconsistencies or contradictions.

Guest contributions from other State aid experts will also be published on the blog at irregular intervals to complement the content of the blog posts.

4. March 2025 |

State Aid Uncovered

by Phedon Nicolaides

Introduction The Commission, in decision 2025/317, spanning 60 pages with close to 300 recitals and concerning the special tax treatment of public casino operators in Germany, found that that treatment constituted unlawful and incompatible State aid that had to be recovered.[1] Following a complaint by the German association of gambling machine operators [Fachverband Spielhallen], the Commission examined i) special tax […]

25. February 2025 |

State Aid Uncovered

by Phedon Nicolaides

Introduction State aid to rescue a company and finance its restructuring is considered to be the most distortionary form of aid. However, it is allowed only to prevent serious social harm and only after notification to and assessment by the Commission. The compatibility assessment is always exhaustive and seeks to establish, among other things, whether State aid is the only […]

18. February 2025 |

State Aid Uncovered

by Phedon Nicolaides

Introduction State aid rules are, in general, less favourable to large companies mostly because they have more own funds, access to cheaper finance [mostly due to longer track record and higher credit ratings] and are more mobile so that regional handicaps have a lesser effect on them. Size also brings other advantages such as the ability to hire top economic […]

11. February 2025 |

State Aid Uncovered

by Phedon Nicolaides

Introduction A perennial question is whether competitors of aid recipients have legal standing to appeal against Commission decisions that either authorise aid or find that a public measure does not constitute State aid. The answer depends on whether the Commission decision is adopted without the opening of the formal investigation procedure or after a form investigation. It is easier to […]

3. February 2025 |

State Aid Uncovered

by Phedon Nicolaides

Introduction On 23 January 2025, the Court of Justice delivered its judgment in case C‑490/23 P, Neos v Ryanair.[1] Neos, a private airline licensed in Italy, appealed against the judgment of the General Court in case T-268/21, Ryanair v Commission, by which it annulled Commission decision SA.59029 concerning an Italian compensation scheme for airlines with an Italian operating licence.[2] The […]

3. February 2025 |

State Aid Uncovered

by Phedon Nicolaides

Introduction State aid to support the generation of electricity from renewable sources must, as standard practice, be granted on the basis of a competitive selection process whereby the most efficient operator gets aid first. With a binding budget, the least efficient operators are excluded. However, there is an exception to this rule for small installations and in situations where there […]

21. January 2025 |

State Aid Uncovered

by Phedon Nicolaides

Introduction The first judgment of 2025 on State aid was rendered by the Cour of Justice of the EU [CJEU] in case C-588/23, Scai, on 16 January 2025. It was a response to a request for a preliminary ruling by an Italian court.[1] Scai had initiated legal proceedings before a national court to contest a request by Regione Campania for […]

14. January 2025 |

State Aid Uncovered

by Phedon Nicolaides

Introduction The Temporary Crisis and Transition Framework for State aid expired on 31 December 2024. However, certain provisions remain in force until 31 December 2025. Those provisions are the following: Section 2.5.1: Investment aid for accelerating the rollout of renewable energy and for energy storage. Section 2.5.2: Operating aid for accelerating the rollout of renewable energy and for energy storage. […]

9. January 2025 |

State Aid Uncovered

by Phedon Nicolaides

Introduction During the covid-19 pandemic there were fewer bankruptcies than normal. The consensus opinion is that the vast amounts of liquidity that were pumped into EU economies saved not only healthy companies but also many of those that would have otherwise gone out of business. Although the large-scale support schemes were necessary, they also created a problem: how to separate […]

3. February 2025 |

State Aid Uncovered

by Phedon Nicolaides

Introduction State aid to support the generation of electricity from renewable sources must, as standard practice, be granted on the basis of a competitive selection process whereby the most efficient operator gets aid first. With a binding budget, the least efficient operators are excluded. However, there is an exception to this rule for small installations and in situations where there […]

21. January 2025 |

State Aid Uncovered

by Phedon Nicolaides

Introduction The first judgment of 2025 on State aid was rendered by the Cour of Justice of the EU [CJEU] in case C-588/23, Scai, on 16 January 2025. It was a response to a request for a preliminary ruling by an Italian court.[1] Scai had initiated legal proceedings before a national court to contest a request by Regione Campania for […]

14. January 2025 |

State Aid Uncovered

by Phedon Nicolaides

Introduction The Temporary Crisis and Transition Framework for State aid expired on 31 December 2024. However, certain provisions remain in force until 31 December 2025. Those provisions are the following: Section 2.5.1: Investment aid for accelerating the rollout of renewable energy and for energy storage. Section 2.5.2: Operating aid for accelerating the rollout of renewable energy and for energy storage. […]

9. January 2025 |

State Aid Uncovered

by Phedon Nicolaides

Introduction During the covid-19 pandemic there were fewer bankruptcies than normal. The consensus opinion is that the vast amounts of liquidity that were pumped into EU economies saved not only healthy companies but also many of those that would have otherwise gone out of business. Although the large-scale support schemes were necessary, they also created a problem: how to separate […]

17. December 2024 |

State Aid Uncovered

by Phedon Nicolaides

Introduction Germany has been very creative in devising measures of support of renewable sources of energy that do not constitute State aid [see the landmark judgments in PreussenElektra, EEG2012, etc]. The decisive element in those measures was the absence of state resources. In January of this year, Germany succeeded to persuade the General Court that a new measure was also […]

10. December 2024 |

State Aid Uncovered

by Phedon Nicolaides

Introduction Compliance with the rules on the cumulation of State aid can be tricky for several reasons. First, all aid granted by all public authorities for the same project needs to be taken into account. Second, this requires identification of the relevant eligible costs, as the same undertaking may legally receive multiple awards of aid for different projects whose eligible […]

7. January 2025 |

State Aid Uncovered

by Phedon Nicolaides

Introduction In June 2016, the Commission received a complaint from the Medical Chamber of Slovenia – a professional organisation of private medical doctors and dentists practicing in Slovenia – concerning alleged State aid granted by Slovenia to public hospitals and public healthcare centres. With decision SA.45844, the Commission recently decided that the public funding of public hospitals and healthcare centres […]

3. December 2024 |

State Aid Uncovered

by Phedon Nicolaides

Introduction A perennial question by aggrieved investors who feel cheated by u-turns in public policy is: “May I claim compensation for damage that I have suffered as a result of non-payment of the State aid that was promised to me?” As a result of recent case law, it is now clear that there are several answers to this question: First, […]

26. November 2024 |

State Aid Uncovered

by Phedon Nicolaides

Introduction This article reviews two judgments concerning a claim that compensation does not constitute State aid and a complaint that the Commission had failed to act, respectively. The latter case is particularly interesting because it is probably the only judgment in the past decade or two that the Court of Justice has actually upheld a claim that the Commission breached […]

19. November 2024 |

State Aid Uncovered

by Phedon Nicolaides

Introduction In June 2016, the Commission received a complaint from the Medical Chamber of Slovenia – a professional organisation of private medical doctors and dentists practicing in Slovenia – concerning alleged State aid granted by Slovenia to public hospitals and public healthcare centres. With decision SA.45844, the Commission recently decided that the public funding of public hospitals and healthcare centres […]

3. December 2015 |

Guest State Aid Blog

by Emanuela Matei

The following blog post is another contributory piece by Emanuela Matei, Associate Researcher at the Centre of European Legal Studies, Bucharest. Matei holds a Juris Master in European Business Law (Lund University, June 2012), a Magister legum (Lund University, June 2010) and a BSc in Economics & Business Administration (Lund University, June 2009). We are very glad to welcome her […]

11. November 2015 |

Guest State Aid Blog

by Dimitrios Kyriazis

The following is a summary of the main points that were presented and the issues that were discussed in the seminar on State aid in Tax Measures that was held in Brussels on 26-27 October 2015. The summary has been prepared for information purposes only and it is not meant to be a precise record of the proceedings of the […]

5. November 2015 |

Guest State Aid Blog

by Lexxion Publisher

Find below the court’s diary for all State aid cases. Would you like to write a comment on one of them? Please don’t hesitate and get in touch with us ([email protected]), we are happy to publish your comment on the blog. Wednesday 11/11/2015 Judgment in Case C-505/14 – Klausner Holz Niedersachsen (Court of Justice – Second Chamber) Thursday 12/11/2015 Judgment in […]

22. October 2015 |

Guest State Aid Blog

by Emanuela Matei

The following blog post is a contributory piece by Emanuela Matei, Associate Researcher at the Centre of European Legal Studies, Bucharest. Matei holds a Juris Master in European Business Law (Lund University, June 2012), a Magister legum (Lund University, June 2010) and a BSc in Economics & Business Administration (Lund University, June 2009). We are very glad to welcome her […]

12. October 2015 |

Guest State Aid Blog

by Lexxion Publisher

Any comments on #Stateaid? Get in touch: Stateaidhub[at]lexxion.eu Thursday 01/10/2015 Judgment in Case C-357/14 P – Electrabel and Dunamenti Erőmű v Commission (Court of Justice – Third Chamber) Tuesday 06/10/2015 Judgment in Case C-303/13 P – Andersen v Commission (Court of Justice – Grand Chamber) Thursday 08/10/2015 Hearing in Joined Cases T-479/11 & T-157/12 – France v Commission, […]

24. September 2015 |

Guest State Aid Blog

by Gian Marco Galletti

The following article summary is a contributory piece by Gian Marco Galletti. The full piece was published in the Common Market Law Review. Galletti is working as a researcher at the Dickson Poon School of Law since 2013. He is currently working on a PhD in European law under the supervision of Prof. Andrea Biondi. He holds an LLB with […]

1. September 2015 |

Guest State Aid Blog

by Lexxion Publisher

Any comments on #Stateaid? Get in touch: Stateaidhub[at]lexxion.eu Thursday 03/09/2015 Judgment in Case C-89/14 – A2A (Court of Justice – Fifth Chamber)Tuesday 08/09/2015 Hearing in Case T-103/14 – Frucona Košice v Commission (General Court – Second Chamber)Thursday 17/09/2015 Judgment in Case C-33/14 P – Mory and Others v Commission (Court of Justice – Third Chamber) Friday 18/09/2015 Judgment […]

2. July 2015 |

Guest State Aid Blog

by Lexxion Publisher

Any comments on #Stateaid? Get in touch: Stateaidhub[at]lexxion.de Wednesday 01/07/2015 Opinion in Case C-357/14 P Dunamenti Erőmű v Commission (Court of Justice – Third Chamber) Thursday 02/07/2015 Judgment in Joined cases T-425/04 RENV France v Commission, T-444/04 RENV Orange v Commission (General Court – Sixth Chamber, Extended Composition) Wednesday 08/07/2015 Hearing in Case T-287/11 Heitkamp BauHolding v Commission (General Court – Ninth […]

17. June 2015 |

Guest State Aid Blog

by Lexxion Publisher

Last week our 13th Experts’ Forum on New Developments in European State Aid Law took place. From 10th to 12th June 2015 a group of enthusiastic professionals interested in State Aid gathered at the Club of the University Foundation in Brussels to discuss the most recent issues on the topic. In the realm of this conference, we were proud to announce our […]

3. June 2015 |

Guest State Aid Blog

by Lexxion Publisher

Any comments on #Stateaid? Get in touch: Stateaidhub[at]lexxion.eu Thursday 04/06/2015 Judgment in Case C-15/14 P Commission v MOL (Court of Justice – First Chamber) Tuesday 09/06/2015 Hearing in Case T-515/13 Spain v Commission (General Court – Seventh Chamber) Wednesday 10/06/2015 Hearing in Case C-367/14 Commission v Italy (Court of Justice – Third Chamber) Hearing in Case T-719/13 Lico Leasing and Pequeños y […]