The granting of exclusive rights may confer an advantage but does not in itself result in transfer of state resources. Private undertakings that hold exclusive rights are not utilising state resources by the mere fact that they operate under rights conferred by the state. Price regulation is a regulatory act which does not entail transfer of state resources. Introduction […]

State Aid Law

Blog

State Aid Uncovered Blog

In Lexxion’s State Aid Uncovered blog, Prof. Phedon Nicolaides publishes weekly critical analyses of recent State aid judgments and decisions. Each post presents the key points of a court judgment or EU Commission decision, places it in the context of similar case law or practice, assesses the underlying reasoning and highlights any inconsistencies or contradictions.

Guest contributions from other State aid experts will also be published on the blog at irregular intervals to complement the content of the blog posts.

18. February 2015 |

State Aid Uncovered

by Phedon Nicolaides

Public service obligations must be entrusted by an official act and defined with sufficient precision. Imprecise definition of public service obligations makes it impossible to identify the costs which are caused by such obligations. Consequently, imprecise definition of public service obligations makes it impossible to grant compensation because subsidisation of non-eligible costs cannot be excluded. Compensation may not be granted […]

16. February 2015 |

Guest State Aid Blog

by Richard Craven

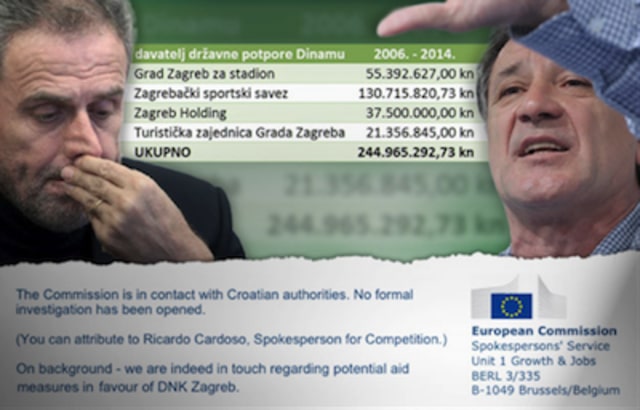

GNK Dinamo Zagreb: Will the next act of the sports and State aid saga play out in the EU’s newest capital? The spectre of EU State aid law has loomed over professional club football in Europe since the Commission’s initiation, in 2013, of in-depth investigations into five football clubs in the Netherlands (SA.33584) and seven clubs in Spain […]

13. February 2015 |

Guest State Aid Blog

by Lexxion Publisher

On Thursday 12th February the CJEU passed down its ruling in C-37/14, finding that France did not take all necessary measures to recover aid illegally granted to the fruit and vegetable sector and thereby failed to fulfil its obligations under Article 288(4) TFEU. The full ruling is available here and the press release can be accessed here. The aid in question concerned ‘contingency plans’ […]

10. February 2015 |

Guest State Aid Blog

by Lexxion Publisher

A quick look at the month ahead in the GC/CJEU and reminder about how to get in touch with your news, views and information on how to write a post: Stateaidhub[at]lexxion.de Court’s Diary As we look to the month ahead, there are several State aid cases trickling through the EU Courts to watch out for. Here’s an update from the […]

9. February 2015 |

State Aid Uncovered

by Phedon Nicolaides

Different interventions that aim to finance the same restructuring plan constitute a single measure. A private investor may consider a possible damage of its reputation from laying off workers but the damage has to be quantified. Finance support of employees provides an indirect benefit to the employer. Introduction In this article I review two similar cases: a judgment of […]

3. February 2015 |

State Aid Uncovered

by Phedon Nicolaides

Security of energy supply can be a service of general economic interest. Avoiding harm to the environment is not one of the principles that underpin the internal market and which may not be violated by State aid measures. Determining whether competition is distorted does not require definition of the relevant markets. This article examines two apparently different but in […]

27. January 2015 |

Guest State Aid Blog

by Erika Szyszczak

A detailed note on Case C-518/13 The Queen, on the application of Eventech Ltd v The Parking Adjudicator (judgment of 14th January 2015) An enduring feature of EU law is that it may be used in an opportunist manner in some of the lowest tribunals in the EU to create challenges to national rules and policies. This was how the Eventech case arose. […]

26. January 2015 |

State Aid Uncovered

by Phedon Nicolaides

Public infrastructure which is not exploited for commercial purposes does not result in an advantage for its users. Undertakings which are subject to different regulatory requirements can be treated differently. Cross-border trade can be affected even when there is no direct provision of cross-border services. Introduction The Leipzig-Halle judgment of 2011 was a shock to public funding of infrastructure […]

22. January 2015 |

Guest State Aid Blog

by Dimitrios Kyriazis

The Commission’s opening decision: What should we make of Amazon’s ‘advance pricing agreement’ (APA) and its alleged (non-) compliance with the ‘arm’s length principle’ (ALP)? In early October 2014, the European Commission notified Luxembourg of its decision to open a state aid investigation in relation to the tax treatment of the Amazon group by the Luxembourgish tax authorities. This opening […]

12. April 2013 |

State Aid Uncovered

by Phedon Nicolaides

Introduction: Objective justification of price differentiation In a landmark judgment 25 years ago [February 1988], the Court of Justice established that business behaviour that appears to deviate from normal market practices can still conform with the market economy operator principle [MEOP] which is a variation of the better known market economy investor principle [MEIP]. Both principles are based on the […]

7. April 2013 |

State Aid Uncovered

by Phedon Nicolaides

Introduction In the previous posting I examined the funding of a regional airport. In this posting I look at a case concerning an airline; more specifically, the sale of three subsidiaries of Polish airline LOT.[1] During the past five or so years, the Commission has had to deal with many measures involving different kinds of public support to airlines [e.g. Alitalia, […]

30. March 2013 |

State Aid Uncovered

by Phedon Nicolaides

During the past 18 months or so, the European Commission has launched more than 20 investigations in the funding of regional airports and the arrangements that these airports have concluded with budget airlines such as Ryanair. This posting analyses a very recent Commission decision which found that no State aid was granted to either the airport operator or Ryanair. This […]

25. March 2013 |

State Aid Uncovered

by Phedon Nicolaides

On 19 March 2013, the Court of Justice delivered an important judgment in case C-399/10 P, Bouygues v European Commission concerning aid that was granted by France to France Telecom. The case was an appeal to an earlier ruling of the General Court in case T 425/04 France and Others v Commission which annulled Article 1 of Commission Decision 2006/621 […]

16. March 2013 |

State Aid Uncovered

by Phedon Nicolaides

This post examines the two latest judgments of EU courts on State aid. They do not introduce any novel approaches to the interpretation of Article 107(1) TFEU but they confirm and clarify the obligations of the State in its dealings with undertakings. T-387/11, Nitrogenmuvek Vegyipari v European Commission On 27 February 2013, the General Court rendered its judgment in […]

8. March 2013 |

State Aid Uncovered

by Phedon Nicolaides

The obligation of the state to act as a private vendor When a public authority sells an asset to an undertaking, it must sell it at market price. The case law is clear on this point, especially with respect to the sale of public land or a building. Such a sale may constitute state aid “where it is not […]

1. March 2013 |

State Aid Uncovered

by Phedon Nicolaides

The previous posting examined a case where the European Commission applied the Market Economy Investor Principle [MEIP]. This is the principle that is used to determine whether there is state aid in commercial transactions between public authorities and undertakings. According to Article 345 of the Treaty on the Functioning of the European Union [TFEU], the European Union is neutral with […]

18. February 2013 |

State Aid Uncovered

by Phedon Nicolaides

On 3 October 2012, the European Commission concluded, in case SA.33988, that OPAP, the Greek operator of games of chance received no state aid because the Market Economy Investor Principle applied.[1] At first glance there is nothing unusual about a finding of no aid. But, as always, the devil is in the detail. OPAP holds the exclusive rights to organise various […]

19. February 2013 |

State Aid Uncovered

by Phedon Nicolaides

State Aid Uncovered State aid law and policy evolve all the time. The basic rules are fairly stable but their interpretation and application are frequently adjusted to take into account changes in market conditions, novel forms of cooperation between public authorities and companies and ever more complex funding instruments and arrangements. This blog tracks the evolution of state aid law […]