Introduction

The European Commission recently approved a modification of a Czech scheme for the support of district heating [SA.118343]. The modification concerned an increase of the original budget due to a) a significant rise of carbon allowance prices, b) a higher than expected demand for aid and c) strategic shifts towards accelerated decarbonisation. The original scheme is authorised by decision SA.103821. This decision is rich in useful information on the calculation of the amount of aid which financed by the Modernisation Fund.[1]

Measures to aid heating or cooling fall within the EU’s transition into a clean and carbon-neutral economy by 2050. The heating and cooling sector accounts for about half of the Union’s final energy consumption.

As described in the original Commission decision, the objective of the scheme is to modernise “(6) the thermal energy supply system [TESS], a system of central distribution of heat formed by interconnecting sources of heat and a distribution system serving to supply thermal energy for heating, cooling, hot water preparation and industrial processes. Around 40% of the Czech population is connected to the TESS.”

The scheme “(7) supports investments for the replacement of the existing heat sources used in the TESS with: (a) renewable energy sources; (b) waste heat energy; (c) electricity; (d) high-efficiency cogeneration based on waste to energy; (e) high-efficiency cogeneration based on natural gas and other natural and synthetic gases with a lower emission factor; (f) energy transferred from the surrounding environment (e.g. through the use of heat pumps).”

The beneficiaries of the scheme are owners of heating installations such as heat generation units, district heating systems, and new production unit of thermal energy, provided that the heat output from this source is transferred to an existing district heating system.

Eligible projects are the following: (a) Conversions of existing coal-fired heat generation units; (b) replacement of existing heat generation units with new ones.

However, “(17) support will be granted only for heat generation units based on: (a) renewable energy sources, also in connection with high-efficiency cogeneration; (b) high-efficiency cogeneration based on waste to energy; (c) high-efficiency cogeneration based on natural gas and other natural and synthetic gases produced from low-carbon sources with a lower total emission factor compared to natural gas.”

In addition, “(18) supported projects should lead to a reduction in: (a) CO2 emissions of at least 20%, or 15% for projects involving heat generation through waste to energy; (b) primary non-renewable energy consumption of at least 10%, or 15% for projects involving heat generation through waste to energy.”

The estimated budget of the original scheme was EUR 1.200 billion (EUR 400 million/year). The approved modification raised the budget to EUR 3.2 billion; i.e. an increase of EUR 2 billion. The scheme is entirely financed by the Modernisation Fund. The amount of aid per project is determined according to the funding gap of each project.

In order to demonstrate the necessity of the aid, the Czech authorities identified two “reference projects” representative of the different typologies of projects that can be granted aid under the scheme.

These reference projects are described in paragraph 29 of the Commission decision: “(a) A modernisation project for the replacement of coal with biomass based high-efficiency cogeneration for the generation of heat in an existing heat generation unit (“Project A”). (b) A replacement project for the replacement of an existing heat generation unit using natural gas with a new unit using high-efficiency cogeneration based on waste to energy (“Project B”).”

“(31) The prices of heat and electricity used to estimate the funding gap for the two reference projects were determined in accordance with the prices set by the Energy Regulatory Office. In particular, the electricity price was set on the basis of a long-term outlook, in order to limit the effects of the current volatility of the energy market. The inflation rate used for the calculations is set at the level of 2% to reflect the long-term inflation target.”

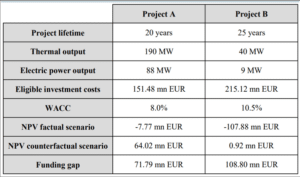

A quantification of the cost and revenues and the resulting funding gap of each of the reference projects are summarised in Table 1 which is reproduced below. It presents the relevant data of the reference projects.

Table 1: Reference projects

With respect to the counterfactual scenario, the likely option for operators “(32) would be continuing the operation of existing heat generation units or investing in the construction of a new gas-fired heat generation unit. In particular, for the calculation of the funding gap included in Table 1 the counterfactual scenario assumed were respectively: (a) the installation of a new natural gas fired cogeneration installation with a thermal output of 190 MW and an electricity output of 88 MW; (b) the installation of a new heat generation unit using natural gas with a thermal heat output of 40 MW.”

Requirements for determining the funding gap of individual projects

In order to receive support under scheme, aid applicants have to submit the detailed funding gap calculation for their proposed project. The calculation must include all relevant costs and revenues for the factual and a realistic counterfactual scenario which could be carried out in the absence of aid.

Interestingly, the scheme pre-determines the counterfactual scenarios that may be chosen by aid applicants. “(34) (a) continuing the operation of existing heat generation units based on fossil fuels; (b) investing in the construction of a new gas-fired heat generation unit (without combined production of electricity where the investment for which an application is submitted is a gas-fired high-efficiency cogeneration unit).”

Other counterfactual scenarios can be submitted but they must be discussed with the granting authority before submission of applications.

Also interesting is that “(34) counterfactual scenarios consisting in the long-term continuation of existing, environmentally unsustainable activities will not be considered realistic and, therefore, acceptable.” Why this is not acceptable is not explained in the decision, but it must be because such activities that may be legal today would be gradually phased out as the relevant regulations become stricter.

For projects which are subject to mandatory EU standards or are required to implement best available techniques [BAT] as defined in Directive 2010/75, the cost of compliance with the relevant regulatory requirements must be included in the counterfactual scenario. In other words, such costs cannot benefit from State aid as the aid would not have any incentive effect.

Applicants have to fill in an excel file that calculates automatically the cash flow for the factual and counterfactual scenarios and the funding gap as the difference between the net present value [NPV] of the cash flows of the factual and counterfactual scenario. However, the funding gap excludes any potential operating losses.

The information that must be submitted includes “(37) (a) the timeline of implementation of the project; (b) the thermal and electric power output of the project as well as load data; (c) the financing structure expected for the project and the weighted average cost of capital (WACC); (d) the eligible investment expenditures identified based on the criteria described in recital (39); (e) the operating expenditures broken down in fuel costs, emission allowances costs and other operating costs; (f) the selling price for heating and electricity as well as a breakdown of other sources of revenues.”

Projects have to conform with the following cumulative conditions: “(39) (a) they must be in accordance with Czech and EU legislation; (b) they must be in line with the call for projects and any additional methodological instruction provided by the Czech authorities; (c) they are incurred in accordance with the principles of economy, efficiency and effectiveness; (d) they are reasonable, i.e. correspond to the usual prices incurred in the implementation of the project; (e) they are properly identifiable, verifiable and provable; (f) they are directly and exclusively linked to the implementation of the project and are part of its budget; (g) they are incurred after the submission of the aid application.”

The scheme also specifies the eligible expenditures: “(40) (a) direct implementation expenses, i.e. expenses for construction works, supplies and services directly related to the subject of support and contributing to the objectives of the project concerned; (b) activities of expert technical supervision, ensuring work safety on the construction site; (c) additional work if there are verifiable objective grounds; (d) publicity measures; (e) value-added tax; (f) set-off claims and liabilities between the applicant and the contractor.”

In addition, the scheme lists ineligible costs: “(41) (a) the purchase of second-hand equipment; (b) expenditures for design documentation and design activities; (c) acquisition of immovable property; (d) charges for removal of land from the agricultural land fund or land intended to perform forestry functions and the establishment of other services; (e) direct tax, gift and inheritance tax, property tax, real estate transfer tax, road tax and duty; (f) expenditures to ensure relevant opinions; (g) investments which are not connected directly and solely with the purpose of the project; (h) repayment of loans, interest; (i) management fees (e.g. notary fees, land registry fees, fees for issuing building permits, fees for discharging waste water into surface waters); (j) budget reserve; (k) salaries and other personnel expenses, overheads and operating expenses.”

Selection procedure

Beneficiaries are selected after annual calls for submission of projects. Each call has a budget of EUR 400 million. The normal exclusions under EU rules apply [e.g. undertakings in difficulty, projects that have already started, etc.]

Applications must include: “(47) (a) a feasibility study of the project and documentation at the level of the building permission; (b) an emissions assessment with evaluation of the project in terms of emissions of pollutants; (c) an energy assessment conducted by an specialist with the appropriate authorisation in accordance with the applicable energy management legislation; (d) an analysis of compliance with the rules on State aid.”

Assessment of the presence and compatibility of State aid with the internal market

The Commission quickly found the scheme to constitute State aid and proceeded to assess its compatibility with the internal market on the basis of the Climate, Environment and Energy Aid Guidelines [CEEAG].

According to the CEEAG, State aid must fulfil the two conditions of Article 107(3)(c): It must contribute to the development of an economic activity without affecting trade to an extent that would be contrary to the common interest. As is well-known, the Commission has elaborated these two conditions in more specific criteria in the CEEAG.

With respect to the first condition [the “positive” condition], tt found that the scheme did promote greener heat generation, that the funding gap demonstrated the incentive effect of the scheme, and that it did not violate other EU law.

More specifically on the existence of an incentive effect, the Commission noted that “(82) point 32 CEEAG stipulates that aid granted merely to cover the cost of adapting to Union standards has, in principle, no incentive effect. As explained in recital (35), where generation units do not comply with Union standards at the moment of the application for aid, the cost of compliance with the applicable standards is accounted for in the counterfactual scenario. Therefore, aid does not cover the cost of adapting to Union standards and the requirements of point 32 CEEAG are considered to be fulfilled.”

With respect to the second condition [the “negative” condition], the Commission found that the there was need for State aid, that the aid was an appropriate instrument, that it was proportional and that it did not cause avoidable negative effects on trade and competition.

More specifically, on the proportionality of the aid, the Commission recalled that “(96) point 48 CEEAG explains that State aid is considered to be proportionate if the aid amount per beneficiary is limited to the net extra cost necessary to meet the objective of the aid measure compared to the counterfactual scenario in the absence of aid. Point 51 CEEAG requires Member States to determine the net extra cost based on a comparison between the profitability of the factual and the counterfactual scenario, taking into account all the main costs and revenues, the estimated weighted average cost of capital of the beneficiaries and the net present value of the project cash flows over its lifetime.”

Then the Commission noted that “(97) Czechia has provided the estimations of the funding gap for two reference projects representative of the different typologies of projects that will be granted aid under the notified measure (see Table 1). Czechia explained that the counterfactual scenario for these two projects consists in the installation of new heat generation unit with the same thermal output using natural gas to produce heat (see recital (32)). The funding gap is calculated as the difference between the NPV of the cash flows of the factual and counterfactual scenario, without accounting for potential operating losses.”

On the absence of undue negative effects, the Commission observed that the scheme conformed with points 396-398 of the CEEAG, which, with certain exceptions, exclude aid for projects using the most polluting fossil fuels. “(106) Support [by the scheme] for heat generation is not provided for technologies using fossil fuels with the exclusion of natural gas which could be supported in the context of high-efficiency cogeneration only. In order to ensure compliance with the Union climate targets, projects involving natural gas will be required to be ready to enable the integration of renewable and low-carbon gases (including hydrogen or gases of non-biological origin) or to use other available solutions to reduce emissions (e.g. CCS/CCU). In particular, aid applicants will need to provide detailed information on the technical capability of the projects they intend to receive support for to integrate renewable and low-carbon gases or to install CCS/CCU technologies”.

For the reasons explained above, the Commission considered that “(108) support under the notified measure does not lead to the lock-in of gas-fired energy generation and does not impede the deployment of clean technologies and their use.”

Therefore, the Commission concluded that the positive effects of the aid outweighed its negative effects.

[1] The full text of the two Commission decisions can be accessed at:

https://ec.europa.eu/competition/state_aid/cases1/202516/SA_118343_17.pdf and https://ec.europa.eu/competition/state_aid/cases1/202305/SA_103821_00B70C86-0100-C668-99D7-6B5982479805_147_1.pdf