Introduction

It is not unusual for EU courts to refer to the Commission’s 2016 Notice on the Notion of State Aid as a means of shedding light to the more obscure aspects of that notion. What is very unusual is for EU courts to treat the Notice as if it has the same status as the guidelines that bind the Commission in its assessment of the compatibility of State aid with the internal market. After all, the concept of State aid is objective, as interpreted by the Court of Justice, and the Notice clearly indicates that it only expresses the Commission’s understanding of Article 107(1) TFEU. This implies that if the Commission’s understanding is wrong, then EU courts have to apply what they consider as legally correct. Yet, on 10 April 2024, in case T-486/18 RENV, Danske Slagtermestre v Commission, the General Court held, I believe for the first time, that the Commission deviated from the wording of the Notice.1 Was the Commission bound by the Notice, even if it referred to it?

This is also the first case, at least over the past decade, that an EU court has found that the Commission’s assessment of a State aid measure was marred by a conflict of interest.

On 30 June 2022, the Court of Justice, in case C-99/21 P, Danske Slagtermestre v Commission, set aside the order of the General Court in case T-486/18, Danske Slagtermestre v Commission and referred it back to the General Court.

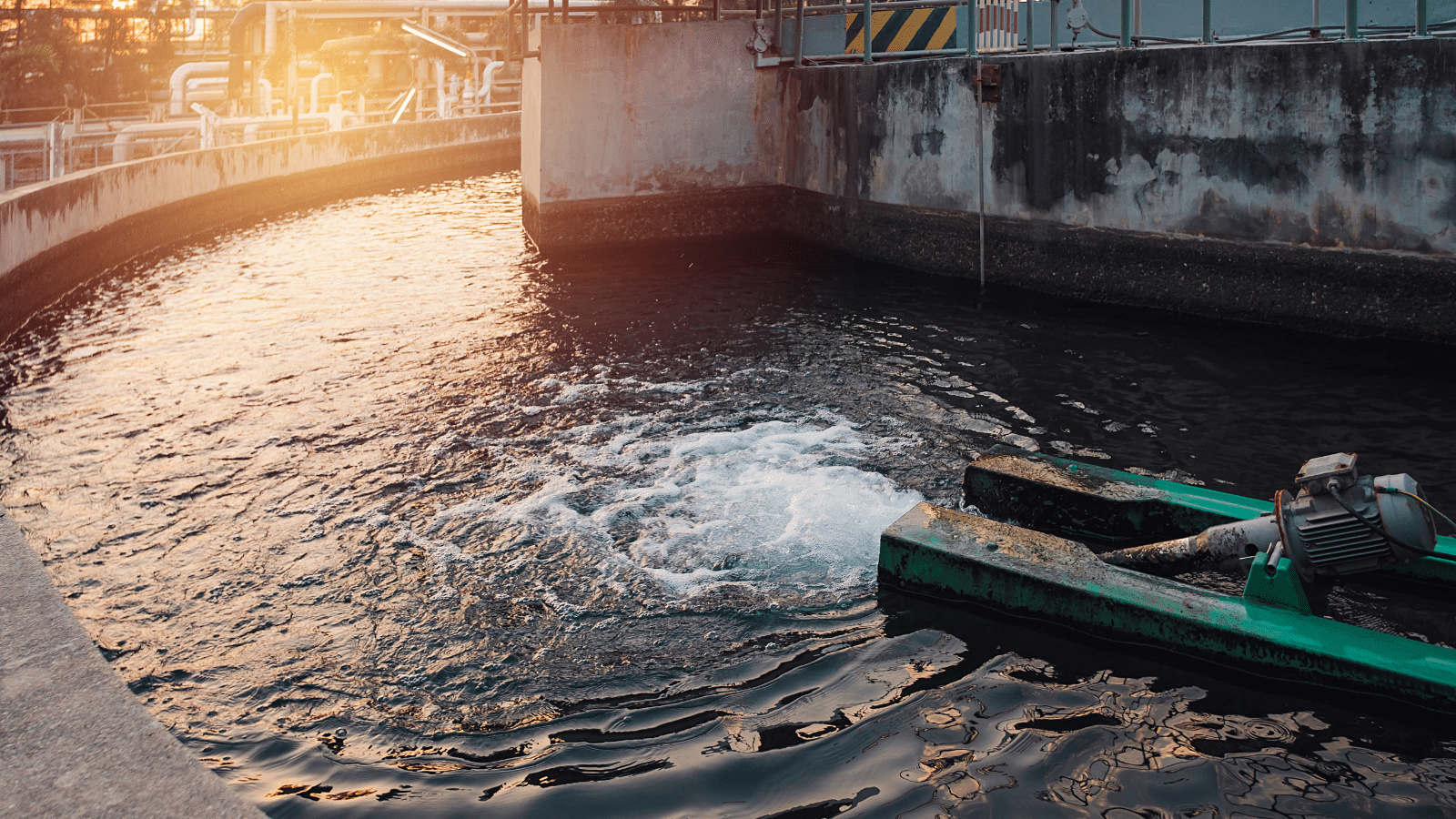

Danske Slagtermestre [DS] sought the annulment of Commission decision SA.37433 concerning a Danish measure on fees for the treatment of waste water. DS is a trade association representing butcher’s shops, slaughterhouses, wholesalers and processing undertakings in Denmark. In 2013, DS complained to the Commission that a Danish law – Law 902/2013 – requiring the payment of fees to waste-water treatment operators granted State aid to large slaughterhouses in the form of a reduction in the fees they had to pay for the treatment of their waste water.

The fees were established according to a degressive “staircase” model based on a rate per cubic metre of waste water discharged. The staircase model was designed as follows:

Step 1: Water consumption of up to 500 m³ per year per property.

Step 2: Water consumption of between 500 m³ and 20,000 m³ per year per property.

Step 3: Water consumption in excess of 20 000 m³ per year per property.

The rate per cubic metre was set degressively for each of the steps as follows:

The rate per cubic metre for Step 1 was set at the standard rate.

The rate per cubic metre for Step 2 was 20% lower than the standard rate for Step 1.

The rate per cubic metre for Step 3 was 60% lower than the standard rate for Step 1.

In other words, the Danish system granted quantitative discounts: The larger the quantity, the lower the rate per unit.

In April 2018, the Commission adopted the contested decision in which it found that the rates introduced by Law 902/2013 did not confer an advantage on specific undertakings and that it did not therefore constitute State aid in the meaning of Article 107(1) TFEU. The Commission considered that a market economy operator would have implemented the staircase model. The users of the waste-water treatment plants incrementally contributed to the profitability of those plants.

DS lodged an appeal against the Commission decision, which, however, was dismissed by order of the General Court in December 2020 [case T-486/18, Danske Slagtermestre v Commission] on the ground that DS lacked standing to bring proceedings.

However, as a result of the judgment of the Court of Justice of June 2022, the General Court had to assess again the appeal on its substance.

Infringement of the requirement of impartiality

DS submitted that the Commission failed to observe the requirement of impartiality laid down in Article 41(1) of the Charter on Fundamental Rights because of a conflict of interest of the member of the Commission responsible for competition matters. Apparently, she had participated, within the Danish Government, in the drafting of Law 902/2013 as Minister for the Economy and the Interior and Deputy Prime Minister.

The General Court, first, recalled that “(27) the requirement of impartiality, which applies to the institutions, bodies, offices and agencies in carrying out their missions, is intended to guarantee equality of treatment, which is at the heart of the European Union. Having regard to the fundamental importance of ensuring the independence and probity of EU institutions, bodies, offices and agencies as regards both their internal functioning and external reputation, the requirement of impartiality covers all circumstances in which an official or agent who is called upon to decide on an issue must reasonably consider that issue as being of such a nature as to be viewed by third parties as a possible source of impairment of his or her independence in that matter”.

“(29) In that regard, it is apparent from the case-law that, in order to show that the organisation of an administrative procedure does not ensure sufficient guarantees to exclude any legitimate doubt as to possible bias, it is not necessary to prove lack of impartiality but is sufficient for a legitimate doubt to arise that cannot be dispelled”.

Then the General Court acknowledged that “(32) it is true, as the Commission points out, (i) that it was the Danish Minister for the Environment and not the Commissioner in question who had presented the draft that led to the adoption of Law No 902/2013 and, (ii) that that law had been adopted following a majority vote of the members of the Danish Parliament.”

However, the Court noted that “(34) the purpose of Law No 902/2013 was to amend the existing rules on water pricing and therefore included measures intended to have an impact on the expenditure of private individuals and undertakings, such as the contribution for the treatment of waste water. It is reasonable to consider that such measures could have been proposed in agreement with the minister responsible for the economy, namely the Commissioner in question.”

Also, “(35) on 26 February 2013, the Commissioner in question had participated on behalf of the Danish Government, together with the Prime Minister, the Minister for Finance and the Minister for Taxation, in a press conference concerning the presentation of that action plan, which included the draft which gave rise to Law No 902/2013. In particular, during that press conference, the Commissioner in question had stated that ‘the Government [was] sending a very clear signal to undertakings’ and that it ‘[would] not impose any further general increases in taxes and duties on undertakings’.”

“(36) Accordingly, the Commissioner in question had taken a position at national level, publicly and explicitly, in favour of the reduction of the contribution for the treatment of waste water.”

From the above observations, the General Court inferred that “(38) it is therefore necessary, in the second place, to examine whether the organisation of the administrative procedure within the Commission that led to the adoption of the contested decision offered sufficient guarantees to prevent such an interest from vitiating that procedure by an infringement of the requirement of impartiality.”

But the competition Commissioner was in a different capacity, in charge of a different portfolio applying different laws. This did not seem to influence the reasoning of the Court which went on to point out that “(39) it is true, […], that Article 250 TFEU provides that [the Commission] is to act by a majority of its members, therefore the Commissioner in question had no casting vote in adopting the contested decision.”

However, “(41) despite the collegiate nature of the method of adopting decisions within the Commission, the Commissioner in question was, as the member responsible for competition, specifically responsible for the preparation of the contested decision – which the Commission moreover confirmed at the hearing, stating that she had ‘ultimate responsibility for the preparation of the proposal for that decision’. In that regard, the preparatory role is an important role as far as the decision ultimately adopted by the Commission is concerned”.

As is also the practice of the Commission that decisions on State aid are signed by the competition Commissioner.

The General Court concluded that “(44) on the face of it, such a situation is such as to give rise, in the eyes of third parties, to a legitimate doubt with respect to possible bias on the part of the Commissioner in question, irrespective of her conduct. Moreover, the Commission has not adduced any evidence capable of calling into question the applicant’s allegations in order to dispel the doubt thus created. As a result, […], it must be concluded that the procedure which led to the adoption of the contested decision did not offer sufficient guarantees of objective impartiality.”

Consequently, the General Court upheld this plea of DS. But, its reasoning is not convincing. It is very well possible that a person in the capacity of a national minister may reach a certain decision while in the capacity as a member of the Commission, relying on different criteria and for different purposes, may very justifiably reach an opposite decision. It seems to me that the important elements here would have been whether there was personal gain or loss for the Commissioner and whether the reputation of the Commissioner would have been stained had she concluded otherwise.

Nonetheless, the Court went on, for the sake of completeness, to examine DS’s plea that Law 902/2013 granted an advantage to certain users such as large slaughterhouses that released a large volume of waste water.

Existence of an advantage

DS argued that the market economy operator principle [MEOP] or the private operator principle [POP] was not applicable and that, even if it were applicable, it was not applied correctly.

Applicability of the MEOP

Advantage is any benefit that a public authority confers to an undertaking, which would be unobtainable under normal market conditions.

The General Court, first, explained that “(52) the characterisation of such an advantage is, in principle, carried out by applying the private operator principle, unless there is no possibility of comparing the State conduct at issue in a particular case with that of a private operator because that conduct is inseparably linked with the existence of infrastructure that no private operator would ever have been able to create or unless the State acted in its capacity as a public authority, although it must be observed that the mere exercise of the prerogatives of a public authority, such as the use of means that are legislative or fiscal in nature, does not by itself render that principle inapplicable, nor does the pursuit of public policy objectives […] It is the economic nature of the State intervention at issue and not the means put into effect for that purpose that renders that principle applicable”.

“(53) In the present case, the measure at issue concerns the pricing of waste water treatment. In that regard, the waste water treatment service is carried out by the infrastructure operators in return for remuneration derived, inter alia, from the contribution for the treatment of waste water which is at issue in the present case. In particular, the purpose and effect of that measure is to reduce the charges applied to the biggest water consumers. It can therefore be likened to a quantitative rebate granted by the operator of an infrastructure to some of its customers, with the result that the State conduct at issue can be compared to that of a private operator.”

Therefore, the General Court concluded that MEOP was applicable to the present case.

“(55) Such a conclusion is not called into question by the applicant’s argument that there is no market for the treatment of waste water. Indeed, even if it were established, such a circumstance would not, in itself, render the market economy operator principle not applicable, since, in the absence of any possibility of comparing the situation of a public undertaking with that of a private undertaking, normal market conditions, which are necessarily hypothetical, must be assessed by reference to the objective and verifiable elements which are available”.

Application of the MEOP

The next step was to determine whether the Commission applied the MEOP correctly. First, the General Court recalled the relevant case law.

“(66) The application of the private operator principle involves the Commission showing, following an overall assessment that takes into consideration all the relevant evidence in the case, that the undertaking or undertakings benefiting from the State measure at issue would manifestly not have obtained a comparable advantage from a normally prudent and diligent private operator in a situation that is as alike as possible and acting under normal market conditions. Within that overall assessment, the Commission must have regard to all the options that such an operator would reasonably have envisaged, all the information available and likely to have a significant influence on its decision, and the developments that were foreseeable at the time when the decision to confer an advantage was taken”.

“(67) In particular, the Commission must assess whether, at that time, the transaction by which the advantage was conferred could be considered rational from an economic, commercial and financial perspective, taking account of its prospects for profitability over the short or longer term and of the other commercial or economic interests which it involved”.

“(69) The Commission has the burden of proving whether or not the conditions for the application of the private operator principle have been satisfied […], and that burden of proof cannot be discharged by making mere assumptions which are not substantiated to the requisite legal standard”.

Then, the General Court noted that “(71) the Commission relied on the ex ante profitability analysis method provided for in the second to fourth sentences of paragraph 228 of the 2016 Notice.”

The General Court also acknowledged that “(72) it is for the Commission, in the exercise of its broad discretion […], to choose the appropriate method, within the framework of its obligation to carry out a complete analysis of all factors that are relevant to the transaction at issue and its context, including the situation of the beneficiary undertaking and of the relevant market, to verify whether the beneficiary undertaking has received an economic advantage which it would not have obtained under normal market conditions”.

In addition, the General Court stressed that “(74) by choosing to apply the ex ante profitability analysis method, as defined in the second to fourth sentences of paragraph 228 of the 2016 Notice, the Commission was in principle required to comply with the conditions laid down therein.”

“(75) It follows that, according to the second sentence of paragraph 228 of the 2016 Notice, in order to determine whether the operator of a non-dedicated public infrastructure makes that infrastructure available to undertakings under market conditions, it must be ascertained whether the ‘users’ of that infrastructure contribute to its profitability […] Thus, it must be held that the ex ante profitability analysis method requires determining the incremental (or marginal) costs and incremental (or marginal) revenues, that is to say, the costs and revenues directly generated by the use of the infrastructure by an additional user, in order to assess whether the presence of the additional user contributes to profitability. Therefore, despite the use of the term ‘users’ in the plural, that method implies, in principle, that it is possible to determine the costs and revenues resulting from the presence of each individual user of an infrastructure.”

“(79) In those circumstances, as the applicant rightly points out, in order to apply the ex ante profitability analysis method provided for in paragraph 228 of the 2016 Notice to the staircase model, the Commission was required to examine, in respect of each undertaking connected to a waste water treatment plant, whether the contribution for waste water treatment paid in accordance with the staircase model was capable of covering the costs arising from its use of the infrastructure in question.”

The Court also referred to the practice of the Commission in cases of air transport infrastructure where there are individual agreements between airports and airlines. Individual pricing makes sense in this case because airlines use different aircraft, transport different number of passengers and require different services. But, in the case of waste-water treatment, there are many users each producing the same effluents with the only difference being the quantity of effluents. Does it make sense for operators of treatment plants to enter into individual agreements setting individual pricing? Despite the reference to users, in plural, in paragraph 228 of the Notice, the General Court, relying on the presence of word “user”, in singular, concluded that the Commission should have examined the economic rationality of the price for each individual user.

Therefore, the Court criticised the Commission for not being able to “(80) examine the costs and revenues specific to each undertaking using the waste water treatment plants in Denmark, since it relied solely on average data relating to total costs and revenues of 6 out of

the 98 municipalities of that country.” In this respect, the Commission should have examined a larger sample of municipalities.

“(81) Accordingly, the applicant is right to claim that, by relying solely on such data, the Commission disregarded the limits that it imposed on its discretion in paragraph 228 of the 2016 Notice.”

Calculation of incremental costs and revenue

The General Court went on to observe that “(82) even if the Commission could have applied the ex ante profitability analysis method without carrying out an examination of each user, such a method entails at the very least that it is in a position to verify that the staircase model is based on an approach which makes it possible to allocate to users, in a sufficiently probable manner, the incremental costs, that is to say, the costs directly incurred by their use of a waste water treatment plant.”

“(83) In that regard, first, the Commission noted, in paragraph 39 of the contested decision, that the staircase model was based on a distribution of the total costs borne by operators of waste water treatment plants between, on the one hand, the fixed costs, divided equally between all users and, on the other hand, the variable costs, allocated to the various users according to their consumption. Second, in paragraphs 40 and 41 of that decision, the Commission considered that the revenue from the contribution for the treatment of waste water, after application of the Step 2 and Step 3 charges, made it possible to cover all the costs borne by the operators of waste water treatment plants, on the basis of the Danish authorities’ estimate that those costs were 20% or even 30% variable costs and 70% or 80% fixed costs”.

“(84) Indeed, it is apparent from those considerations that the Danish authorities followed an approach making the variable part of the contribution for waste water treatment dependent on the variable costs incurred by the operator of a waste water treatment plant, relative to each user.”

“(85) However, in their reply of 18 May 2017 to a Commission request for information, the Danish authorities explained that, in the approach that served as a basis for developing the staircase model, variable costs included only operating expenses (‘OPEX’) related to the quantity of water consumed by a user.”

“(86) It follows that, as the applicant submits, in essence, all the costs which were not linked to the quantity of water consumed were considered to be fixed costs and, therefore, were shared among all the various users, even if such costs existed merely because of the presence of a specific user on the network. That is the case, in particular, with investment expenditure (‘CAPEX’), such as that linked to the creation and extension of the network of pipelines, which were regarded as fixed costs, including if the sole purpose of that expenditure was the connection of a specific user to the network. In that regard, in response to a question put by the Court, the Kingdom of Denmark, while acknowledging that such costs vary according to the distance between the installation and the user, stated that they were shared equally between all users, in accordance with a principle of geographical solidarity.”

“(87) The Commission was thus wrong to state, in paragraph 38 of the contested decision, that it had verified that the contribution for the treatment of waste water, determined using the staircase model, enabled the plant to cover incremental costs in the medium term, which, in its view, included ‘all categories of expenses or investments, such as personnel, equipment and investment costs, induced by the presence of the user’.”

“(88) Therefore, it is clear that the approach on which the staircase model was based did not allow for an adequate definition of the incremental costs borne by the operators of waste water treatment plants.”

“(91) It follows from the foregoing that the Commission disregarded the limits that it imposed on its discretion, in paragraph 228 of the 2016 Notice, when it considered, on the basis of the ex ante profitability analysis method, that the contribution for the treatment of waste water was consistent with the private operator principle.”

It seems to me that the General Court simply disagreed with the Commission on which costs to classify as fixed. There is no generally accepted practice on this point. The General Court considered each extension of the network to be a variable cost, while the Commission regarded it as a fixed cost because once it was incurred it no longer changed with the amount of waste water. The dividing line between fixed and variable costs is not defined in the Notice, so here the General Court could not claim that the Commission deviated from the Notice.

Profit margin

However, the General Court also pointed out that “(92) in the second place, […], the actions of a private operator is in principle guided by prospects of profitability. Thus, where the intervention of a public operator in favour of an undertaking disregards any prospect of profitability, even in the long term, it cannot be regarded as complying with the private operator principle”.

“(93) Indeed, both in paragraph 228 of the 2016 Notice and in point 63 of the 2014 Guidelines, the Commission expressly made compliance with the private operator principle subject to the requirement of a ‘reasonable profit margin’ for the operator of infrastructure where such an operator grants an advantage to users of that infrastructure.”

“(94) In the present case, […], the Commission considered that the discounts introduced by the new staircase model could comply with the private operator principle on the sole condition that the contribution for the treatment of waste water covers the costs incurred by the operators of waste water treatment plants.”

“(95) On the basis of such an assessment, which disregards any prospect of profitability, even in the long term, the Commission, which bears the burden of proving that the conditions for the application of the private operator principle have been satisfied […], could not establish that the contribution at issue complied with that principle”.

“(96) Indeed, […], the Kingdom of Denmark stated that the rules relating to the determination of the contribution for the treatment of waste water were governed by the principle of ‘self-financing’, which, first, requires that the amount of that contribution be sufficient to cover the costs borne by the operator of a waste water treatment plant and, second, excludes the possibility for such an operator to retain a profit margin, since the excess over costs has to be reinvested and no dividend can be distributed to shareholders.”

“(97) Moreover, […], the application of the staircase model leads, on the whole, to a reduction in the amount of the contribution for the treatment of waste water compared to the unitary fee system which it replaces. In that regard, as it acknowledged at the hearing, the Commission assessed the conformity of the staircase model with the private operator principle without, however, examining whether such an operator would have abandoned the system of the unitary fee for the staircase model, even though it appeared less profitable. The ex ante profitability analysis defined in paragraph 228 of the 2016 Notice, […], involves the national measure examined by the Commission contributing ‘incrementally’ to the profitability of the operator of an infrastructure, so that, in order to comply with the private operator principle, that measure is supposed to increase such profitability, even in the long term, and not decrease it.”

“(98) It must therefore be concluded that, by failing to examine whether the contribution for the treatment of waste water enabled the operators of waste water treatment plants to retain a profit margin, the Commission misapplied the private operator principle and, therefore, infringed Article 107(1) TFEU.”

On this point, the General Court is certainly right.

“(105) In the light of the foregoing, the Court concludes that the Commission infringed Article 107(1) TFEU and paragraph 228 of the 2016 Notice when it took the view that the contribution for the treatment of waste water did not entail the existence of an advantage on the ground that it would have been decided upon by a private operator. Therefore, the third plea in law must be upheld.”

Consequently, the General Court annulled the Commission decision.