Introduction

Following a formal investigation, the Commission in decision 2025/775 approved restructuring aid to TAROM, the Romanian airline which is 97% owned by the state.[1]

In 2020, Romania provided rescue aid to TAROM, which was also approved by the Commission in decision SA.56244. The rescue decision was appealed by Wizz Air. Its appeal was dismissed by the General Court in May 2022 [case T-718/20, Whizz Air v Commission]. Wizz Air’s appeal against the judgment of the General Court was also rejected by the Court of Justice in 2024 [case C-440/22 P, Whizz Air v Commission].

The Court of Justice confirmed, for the purposes of assessing whether there was a risk of disruption to an important service which was hard to replicate in the meaning of paragraph 44(b) of the Rescue & Restructuring [R&R] guidelines, the Commission was not required to take into account the size of the market in which TAROM operated or its share of that market.

The restructuring aid that was granted by Romania consisted by two measures:

(a) a series of share capital increases of about EUR 45.8 million, and

(b) a debt write-off to cover the amount of the rescue loan with interest amounting to EUR 49.5 million.

The capital injection was partly intended to cover TAROM’s cash deficit over the restructuring period and repayment of a loan granted to it to offset losses that had been incurred during the covid-19 pandemic. The two restructuring measures amounted to approximately EUR 95.3 million.

The purpose of the restructuring was to renew TAROM’s fleet, implement efficiency measures [e.g. optimisation of routes, closure of agencies, etc], re-organise the company, and reduce operational and administrative costs.

Own contribution

TAROM’s own contribution amounts to EUR 78 million, which is equivalent to 45% of the total restructuring costs of EUR 173 million.

Measures to limit distortions of competition

TAROM would undertake both structural and behavioural measures to reduce distortions of competition caused by the restructuring aid. Structural measures involved downsizing and capacity reduction, divestment and outsourcing of technical services. Behavioural measures concerned commitments that TAROM would refrain from acquiring shares in another company during the restructuring period and publicising the State aid it received when marketing its products and services.

Assessment of the compatibility of the restructuring measures with the internal market

The Commission concluded quickly that the restructuring measures constituted State aid and then examined whether they complied with the provisions of the R&R guidelines.

Undertaking in difficulty

According to point 20 of the R&R guidelines an undertaking is considered to be in difficulty when, without intervention by the state, it would almost certainly go out of business in the short or medium term. This would be the case when at least one of the situations described in point 20(a) to (d) of the guidelines occurred.

“(174) TAROM has depleted more than half of its subscribed share capital as a result of accumulated losses and has thus fulfilled the criterion set out in point 20(a) of the R&R Guidelines”.

“(175) According to point 21 of the R&R Guidelines, a newly created undertaking, that is an undertaking in the first three years of operations in the relevant field of activity, is not eligible for restructuring aid. TAROM is not a newly created undertaking for the purpose of the R&R Guidelines”.

“(176) According to point 22 of the R&R Guidelines, a company belonging to or being taken over by a larger business group is not normally eligible for restructuring aid, unless it can be demonstrated that the company’s difficulties are intrinsic and are not the result of an arbitrary allocation of costs within the group, and that the difficulties are too serious to be dealt with by the group itself”.

“(177) TAROM does not belong to a larger business group and the State has sole control over it”.

Therefore, the Commission concluded that TAROM was an undertaking in difficulty and was eligible for restructuring aid.

Next, the Commission found that the aid prevented social hardship and that it contributed to the development of an economic activity, in accordance to point 44 of the R&D guidelines.

The aid was also capable of returning TAROM to viability within a reasonable time period, as required by points 45-48 of the R&R guidelines. The restructuring plan addressed the weaknesses of the company, was based on realistic assumptions about the evolution of market demand and supply costs, identified foreseeable risks, considered various scenarios and indicated that TAROM could achieve an appropriate return on capital after covering all its costs.

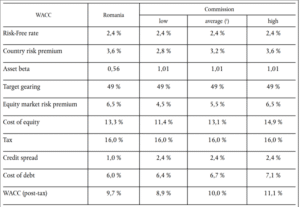

With respect to determining a satisfactory return to capital, the Commission carried out a detailed analysis. Most of the data were commercial secrets and not revealed in the decision, but with respect to the calculation of an appropriate return, the decision indicated the following. “(252) TAROM’s 2026 ROCE ([…] %) is expected to be higher than the WACC (of […] % as calculated at the end of June 2023) and that, as a result of the implementation of the restructuring plan, TAROM is expected to create value for its shareholders and other providers of capital. The Commission assessed the estimations of the WACC parameters […] and found in particular that:

(a) The 2,4 % risk free rate used by Romania corresponds to the 10-year German government bond daily yield average over the period 2023 to 2024 as well as the average over the most recent 6 and 12 months, as per data from the German central bank.

(b) According to a widely used and recognised source, the average country risk premium for Romania is 2,8 % as of January 2024. The 3,6 % country risk premium used by Romania is thus conservative.

(c) For the 0,56 asset beta assumption provided by Romania, the Commission run a conservative sensitivity. By excluding certain peers from the sample identified by Romania [i.e. Aeroflot, SAS and Turkish Airlines], the Commission arrived at an asset beta of 1, which the Commission used in its comparative analysis.

(d) Information from the comparison dataset shows an equity market risk premium of 4,6 % as of January 2024 . The equity market risk premium of 6,5 % used by Romania is thus conservative.

(e) Concerning the credit spread, the Commission conservatively estimated TAROM’s 2026 likely credit rating on the basis of its expected performance in 2026 and, arrived at a more conservative credit spread of 2,35 %.

(f) The tax rate of 16 % used by Romania corresponds to Romania’s corporate tax rate.”

“(253) Table 18 shows a comparison of the results of Romania’s and the Commission’s analyses. As can be seen, the Commission’s assumptions as described above resulted in a WACC range between […] % and […] %, with an average of […] % for TAROM. This is in line with the WACC of […] % provided by Romania. Moreover, both the WACC estimated by Romania and even the upper limit of the range identified by the Commission are below the ROCE of […] % that TAROM is expected to reach in 2026 (see recital (112)). The Commission therefore considers that a WACC of […] % is reasonable.”

Table 18: WACC estimates

Note: (1) Simple average between “low” and “high”.

Necessity and incentive effect of the aid

Point 53 of the R&R guidelines requires Member States to demonstrate the necessity of aid by providing a comparison with a credible alternative scenario without State aid. The comparison between the factual scenario and counterfactual scenario has to show that the intended objective of avoiding market failure or social hardship would not be possible without the aid or would not be possible to the same degree.

Also, State aid must have an incentive effect; i.e. in the absence of the aid, the beneficiary would undertake the restructuring without aid or would be sold or wound up.

“(272) The […] restructuring plan shows that both the liquidity and solvency issues of the beneficiary need to be addressed to solve its financial problems. Without the aid, in the short-term, TAROM would not be able to comply with its financial obligations or to access market financing […] Moreover, TAROM could not implement its restructuring measures due to a lack of funding, which would not only perpetrate the problems that caused its difficulties but also lead to the grounding of aircraft […] In the absence of the restructuring aid, its market exit would in all likelihood be inevitable, given TAROM’s existing indebtedness, the fact that all of its assets with a certain value are pledged as collateral for existing financing or debt, the ensuing unavailability of private market financing, the real risk of the loss of TAROM’s operating licence and of the grounding of its fleet.”

“(273) On the basis of the above, the Commission also concludes that the aid has an incentive effect, as without the restructuring aid TAROM would almost certainly exit the market, risking a disruption of the important service that it provides. Hence, the requirement that the aid has an incentive effect set out in points 38(d) and 59 of the R&R Guidelines is met.”

Proportionality of the aid

Point 38 of the R&R guidelines stipulates that restructuring aid must not exceed the minimum amount necessary to achieve the objective of the aid. In addition, the beneficiary must in principle contribute at least 50% of the restructuring funding itself. This contribution must be free of any aid such as de minimis aid.

In the case of TAROM, its contribution was only 45% of the total restructuring costs; i.e. EUR 78 million out of a total of EUR 173 million. However, the Commission accepted that it constituted a significant contribution.

“(286) In line with point 64 of the R&R Guidelines, the Commission may accept a contribution that does not reach 50 % of the restructuring costs in exceptional circumstances and in cases of particular hardship, if the amount of that contribution remains significant. Those circumstances and cases must be demonstrated by the Member State.”

“(287) In the current circumstances, following the outbreak of the COVID-19 pandemic, the Commission considers that, in the case of TAROM and following the Commission guidance provided in respect of the ‘Temporary Framework for State aid measures to support the economy in the current COVID-19 outbreak’, it may be justified that the own contribution remains below the threshold of 50 % of the restructuring costs, because it remains significant and includes additional fresh funding at market conditions.”

In conclusion, the Commission considered that the restructuring aid conformed with the requirements of the R&R guidelines and approved it.

[1] The full text of the Commission decision is published in the Official Journal of 24 April 2025 and can be accessed at:

https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=OJ:L_202500775