Introduction

Spain notified to the Commission an aid scheme for the promotion of production of renewable hydrogen through electrolysis. The objective of the scheme was to contribute to the reduction of greenhouse gas [GHG] emissions [SA.116676].[1]

As explained in the Commission decision authorising the aid, “(5) hydrogen can be used as a feedstock, a fuel or an energy carrier and storage medium, and has many possible applications across the industry, transport, power, and buildings sectors. Most importantly, using it does not emit CO2 and emits almost no air pollution. Renewable and low-carbon hydrogen offers a solution to decarbonise industrial processes and economic sectors, where reducing GHG emissions is both urgent and hard to achieve. It can replace fossil fuels as a zero-carbon feedstock in chemicals and fuels production and can help decarbonise transport and store surplus renewable power. To contribute to climate neutrality, hydrogen production needs to achieve a far larger scale and its production must become fully decarbonised.”

The guidelines in State aid for climate, environmental protect and energy [and sections 4 & 5 of the recently adopted clean industrial deal State aid framework] allow State aid for the purpose of accelerating the rollout of clean energy and to decarbonise industry. Renewable hydrogen is a clean fuel. This is in line with Directive 2018/2001 on the promotion of the use of energy from renewable sources which requires Member States to ensure that renewable fuels of non-biological origin [RFNBOs] make up at least 42% of the hydrogen used in industry by 2030, and 60% by 2035.

Currently, RFNBO hydrogen is significantly more expensive to produce than fossil-based hydrogen/derivatives. For this reason, not only is State aid permitted, but the EU itself also provides financial assistance to the production of RFNBO hydrogen from its Innovation Fund for the support of programmes for the deployment of net-zero and innovative technologies. The assistance is in the form of grants that are determined through competitive bidding. The use of auctions ensures cost efficiency.

A feature of the 2024 Innovation Fund auctions is the concept of “Auctions-as-a-Service” whereby Member States may choose to use the 2024 Innovation Fund auction mechanism to allocate a pre-defined amount of national funding to RFNBO hydrogen production projects. The Spanish measure in question makes use of this option.

Eligibility conditions

The scheme is open to all undertakings that can produce RFNBO hydrogen using electrolysis and commit to comply with all of the relevant EU rules such as the Renewable Energy Directive 2018/2001.

Spain justified the limited eligibility that focuses on electrolysis projects in order to achieve cost efficiency that is allowed by point 96 of the guidelines on State aid for climate, environmental protection and energy [CEEAG].

Aid allocation

In compliance with the terms of the 2024 Innovation Fund auction, aid would exclusively be allocated through a competitive bidding process that would be open to all bidders with eligible projects. The awarded aid would be equal to the bidder’s bid. No ex post adjustments of the bid, or negotiations after the submission of the bid would be possible.

“(64) In their bids, bidders must state, inter alia: (a) a fixed premium bid price of subsidies, in EUR, per kg of verified and certified RFNBO hydrogen produced; and (b) the expected average yearly volume of RFNBO hydrogen production in kg per year over a subsidy period of 10 years at maximum.”

“(67) All bidders will be subject to a general bid cap of EUR 4 per kg of RFNBO hydrogen produced, meaning that no bid above the cap will be accepted. Simulations based on available project data performed by external consultants of the Commission indicate that a bid cap set at this level mitigates the risk of windfall profits and is sufficiently high so as not to discourage participation in the auction.”

“(70) The ranking of eligible and admissible bids will be based on price only. Projects will thus be ranked from lowest to highest based on the bid price of subsidies (in EUR) per kg of RFNBO hydrogen produced for a maximum of ten years of operating the electrolysis plant. The projects with the lowest aid per kg of RFNBO hydrogen produced are therefore ranked highest and will be selected until the budget of the scheme is exhausted, incentivising companies to apply for lower subsidy amounts.”

Safeguards

The aid scheme also contains an important safeguard. “(73) To deter speculative bids, bidders will need to provide a completion guarantee to the national authorities of Spain covering 8% of the requested maximum grant amount before the award decision […] The completion guarantee must be provided within two months of receiving the invitation to grant preparation. If projects do not reach financial close within 2.5 years, or do not enter into operation within the maximum realisation period of five years, the completion guarantee will be called by Spain, and the award decision will be terminated.”

Learning from experience and informing future EU policy

Another innovative feature of the aid scheme is that “(75) within 6 months of the deadline for submission of bids, [the aid granting authority] will coordinate a “lessons learned” exercise for the 2024 Innovation Fund auction and the scheme.”

“(76) For future Innovation Fund auction rounds, the Terms and Conditions of the Innovation Fund pilot auction and Auctions-as-a-Service may be adapted by the European Commission, if necessary and appropriate. In particular, undersubscription will be corrected to restore effective competition using the Auctions-as-a-Service framework. This may include adjustments to the budget, the general bid cap, and the State aid cumulation rules, as well as the introduction of additional design elements.”

Reference projects

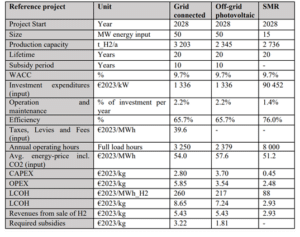

As mentioned above, bidding was capped at EUR 4 per kg of hydrogen produced. The cap was determined on the basis of calculations carried out by a consultant employed by the Commission who identified two reference projects [the consultant was Fraunhofer, Europe’s largest research institute]. The Commission acknowledged that “(78) there is currently significant uncertainty surrounding the relevant costs and revenues of RFNBO hydrogen projects in Europe.” However, the decision indicates the following costs and revenues of reference projects [the table is reproduced from the Commission decision]:

[1] The full text of the Commission decision authorising the scheme can be accessed at:

https://ec.europa.eu/competition/state_aid/cases1/202519/SA_116676_49.pdf

SMR stands for “steam methane reforming” and represents the counterfactual project or scenario. As can be noted in the table, the average levelised cost of hydrogen [LCOH] expressed either in euro per energy unit produced or kilo of hydrogen produced is more than twice that of the counterfactual project [SMR]. Also interesting is that the revenue from the sale of RFNBO hydrogen is higher than the revenue from SMR hydrogen. This is because it was assumed that consumers would be willing to pay a “green premium” of around 2.50 EUR/kg for hydrogen produced from renewable energy sources.

Funding gap, amount of aid and budget

“(82) The funding gap for potential beneficiaries is expected to be 1.81 – 3.22 EUR/kg H2 for Spain.”

“(83) As for the estimation of subsidy per tonne of CO2 equivalent emissions avoided, these are estimated to be 650 EUR/tonne CO2 for the grid-connected reference project and 246 EUR/tonne CO2 for the off-grid reference project, based on the EU ETS SMR Benchmark, and the required subsidies” as set out in the last row of the table above.

The maximum amount available for the scheme for its entire duration is EUR 400 million. “(94) Spain expects the budget to be between EUR 280 and 400 million, subject to budget availability.” The money would be provided from the EU’s Recovery and Resilience Fund.

Commission assessment

First, the Commission explained why the resources for the scheme were “state resources”. This is because the innovation Fund is managed at EU level and therefore its resources do not count as state resources.

In this respect, please note that the website of the Innovation Fund states that “the Innovation Fund grant is not State aid. To cover their remaining costs of their projects, applicants can combine the Innovation Fund grant with other public subsidies. However, the amount of public subsidy a project is permitted to receive will depend on the cumulative maximum amounts set in the applicable State aid rules.”[1]

The revenue for the EU’s Innovation Fund is generated from carbon allowances under the EU’s Emission Trading System. Although ETS revenue primarily flows to national budgets, a share of that revenue subsidises low-carbon innovation and the EU’s energy transition via the Innovation Fund and the Modernisation Fund which supports the modernisation of energy systems and the improvement of energy efficiency in 13 lower-income Member States.

According to the Commission decision, “(107) while support from the Innovation Fund is not considered State aid as Member States do not finance this support from their national budgets and have no influence on how it is used, this is not true of the national funding provided under Auctions-as-a-Service.”

“(108) In the present case, the scheme is entirely financed through the RRF […] The RRF constitutes State resources since Member States have discretion to decide on the use of these resources. Therefore, the Commission concludes that the scheme is financed through State resources.”

“(109) The scheme is established in the national law of Spain (see recitals (31), and (32)). The scheme is therefore imputable to the State.”

Then the Commission confirmed the presence of selective advantage, even though the beneficiaries were to be selected through a competitive process. “(110) The scheme confers an advantage on its beneficiaries in the form of a direct grant that covers relevant investment and production costs and a reasonable profit […] The scheme thus relieves the beneficiaries of costs which they would have to bear under normal market conditions. The advantage granted by the scheme is selective, since it is awarded only to certain undertakings, i.e. undertakings meeting the requirements set out in Section 2.5 and selected through the aid allocation process described in Section 2.7, while other undertakings in a comparable legal and factual situation are not eligible for aid and thus will not receive the same advantage. The aid is also selective since it only favours the production of certain products.”

Next, the Commission assessed the compatibility of the aid according to section 4.1 of the CEEAG. It found the aid to promote an economic activity and to have an incentive effect, in accordance with the first condition of Article 107(3)(c). The big difference in costs between the reference projects and the counterfactual project [SMR] indicated that no undertaking would invest in the production of renewable hydrogen without State aid.

With respect to no violation of other EU law, the decision states that “(133) Spain has confirmed that the proposed measure does not by itself, or by the conditions attached to it or by its financing method constitute a non-severable violation of Union law”.

“(134) The Commission notes that aid under the scheme will be granted in compliance with the Renewable Energy Directive. For RFNBO hydrogen, the Commission notes that installations eligible to receive aid under the scheme must fulfil the GHG emissions savings criteria and the additionality criteria applicable to RFNBOs under the Renewable Energy Directive […] Furthermore, the suppliers will be required to provide buyers with all necessary information and proof of the characteristics of hydrogen, as required by the Renewable Energy Directive”. In addition, the Commission noted that “(203) there are no obvious indications of non-compliance with the do-no-significant harm principle”.

Next, the Commission found the aid to be necessary, appropriate and proportional, as the bidding process would ensure that aid was kept to a minimum.

The Commission also verified that the aid would not cause any undue negative effects on trade and competition. In particular, and in line with point 116 of CEEAG, it checked that the aid would not displace emissions from one sector to another and would instead deliver overall GHG emission.

“(191) The Commission notes that all projects will produce hydrogen that meets the criteria for RFNBOs […] Under the sectoral rules for RFNBOs, the electricity used would either be from additional renewable sources, or be sourced from the grid when the emission intensity of the marginal generator is sufficiently low to avoid significantly increasing demand for fossil fuels or increasing GHG emissions. If beneficiaries also produce non-RFNBOs, operating aid will not cover the costs of this production, and the GHG emissions savings of these must be at least 70% on average over the subsidy period […] The projects would thus not prolong the consumption of fossil-based fuels, nor lead to a mere sectoral displacement of emissions. Although a significant share of the aid will cover OPEX [see the table above], the aforementioned safeguards help ensure that electrolysers are operated in a manner that minimises environmental harm. Therefore, the requirements in points 116, 121, 127 and 129 CEEAG are fulfilled.”

With respect to the impact of the aid on competition, “(198) point 132 CEEAG states that Member States should demonstrate how the proposed measure will not lead to distortions of competition, for example, through increased market power, should the measure be expected to benefit a particularly limited number of beneficiaries.”

“(199) Spain has estimated that the scheme will support 4 to 7 projects […] While this number is limited, the risk of distorting competition and trade is kept to a minimum by the aid being granted through a competitive bidding process. While Spain expects the scheme to add up to 345 MW of electrolysis capacity […], the EU Hydrogen Strategy calls for 40 GW of renewable hydrogen electrolysers by 2030. The scheme will therefore support a small proportion of the total expected renewable hydrogen producers in the EU market. The Commission has therefore not identified risks of additional competition distortions. The requirements of point 132 CEEAG are therefore fulfilled.”

Since the aid would generate positive effects and the likely negative effects were limited and necessary for the achievement of the objectives of the project, the Commission approved the measure.

[1] It can be accessed at: